Stocks: The Good, The Bad and The Ugly

Early look at earnings reactions and more

Good morning advisors,

Individual equities are in focus now more than ever as we get into the heart of earnings season. This week’s edition of Stocks: The Good, The Bad and The Ugly will see highlight the reaction to some of the major companies to already report and look at individual names within some major themes including:

Financials: Good reaction, but still not out of the woods

Energy: Mixed picture amid commodity choppiness

Biotech: Continues to outperform, but bigger is better

Aerospace and Defense: Emerging leadership

Staples and Utes: Selectivity becoming more important

Restaurants: Holding up better than most

The early winner so far: NFLX

Netflix popped 13% yesterday following their Tuesday earnings report. The stock cleared resistance at $253, which should now be viewed as support. It will have to battle a downward sloping 200-dma, but filling the gap near $330 is now a possibility.

The biggest loser so far: GNRC

They say surprises happen in the direction of the underlying trend. For Generac that trend has been down for months. GNRC was featured in the very first edition of this report and I called it a short when it was trading at $175. GNRC fell 25% yesterday and is down 36% since that report.

I certainly won’t get everything right, and this isn’t meant to be a victory lap. The point is that these types of moves can occasionally happen to stocks trading at 52-week absolute and relative highs. But they happen ALL THE TIME to stocks trading at 52-week absolute and relative lows. And there are a lot of charts out there that check both those boxes.

Financials: Good reaction, but still not out of the woods

JPM

A response at $104 is what investors needed to see from JPMorgan and a response at $104 is what they got. However, the risk/reward here looks pretty poor, as the stock has yet to make a higher high and there is a cluster of resistance near $125.

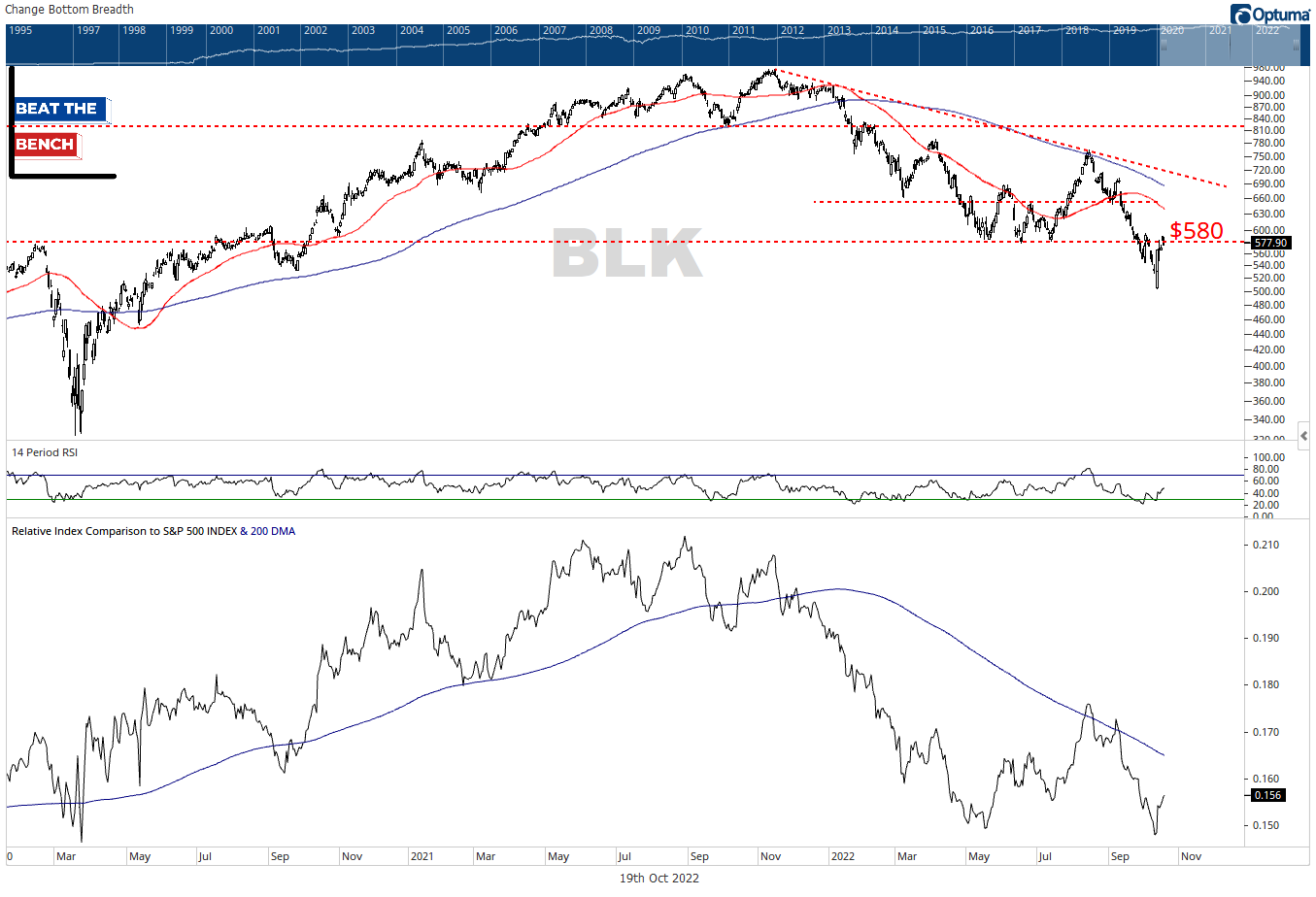

BLK

Few stocks had as big of an intraday reversal last Thursday as BlackRock. It has managed to hold those gains post-earnings report but is having more trouble reclaiming its summer lows. Negative bias.

USB

US Bancorp popped on earnings like nearly all the banks, unfortunately this looks like a rally to sell. The stock had already broken key support prior to the report, and that level (~$43) is now acting as resistance.

Energy: Mixed picture amid commodity choppiness