Stocks: The Good, The Bad, and The Ugly

Hunting for long opportunities

Good morning advisors!

This week started off on an encouraging note, with the S&P 500 reclaiming its June lows, amid modestly improved breadth and a decent 2-day momentum surge.

The last 24 hours have been a bit less encouraging and served as a reminder that there is no such thing as an “all-clear” below a downward sloping 200-day moving average. Nevertheless, I made a particular point to try and find opportunities on the long side in this report, even if they may not all meet our classic definition of a “good” stock in a solid uptrend.

Below are 10 potentially “good” stocks, 5 stocks to continue to avoid (The Bad), and the key levels on 5 important stocks that are searching for direction (The Ugly).

The Good

IPG: Interpublic Group of Companies

IPG hasn’t been a good stock, but we are looking for opportunities and the risk here is well-defined. $25 is as clear of a support level as you will ever find, and the stock is so far bouncing off it. New money can enter and use $25 as a stop-loss because if it breaks that support, all bets are off for how low it could go. First resistance at $31.

CDW: CDW Corp

CDW jumped 6.6% in the first three trading days of this week and that spike is coming right where the stock needs it to. I’ve featured this one before, and really like the cup and handle pattern playing out in the relative chart. July low at $152 is first support, followed by the pre-Covid high at $145.

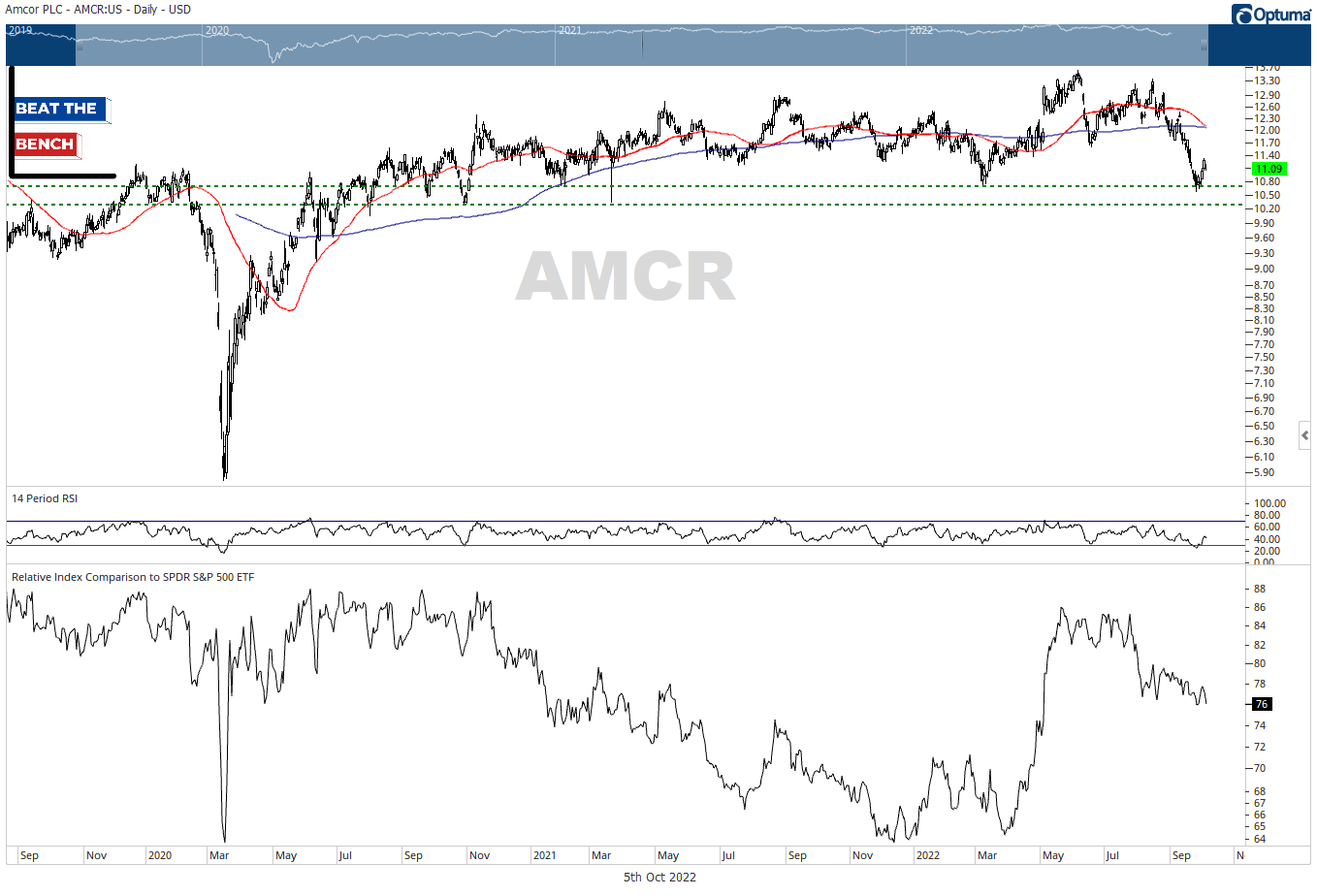

AMCR: Amcor PLC

Amcor has only been listed since 2019, but during its history the mid-$10s has been an incredibly important area. It is surging off those levels to start this week, and like the others featured so far, offers a potential high risk/reward option if using $10.30 as a stop loss.

Keep reading with a 7-day free trial

Subscribe to Brown Technical Insights to keep reading this post and get 7 days of free access to the full post archives.