Stocks: The Good, The Bad and The Ugly

Breakouts from big bases, beaten-up high flyers and more

Good morning,

3 days into this week and bulls have even more to cheer about. After dropping slightly on Monday, the S&P 500 has kissed its August highs in textbook fashion and appears to be resuming higher. It is just one level and nothing has to happen, but the beauty of a breakout is the risk is so well-defined. Like the breakouts from big bases I am featuring today, if the S&P 500 is above 4325 there simply isn’t any reason to spend much time thinking about the bear case.

This week we’re also looking at:

Beaten-up high flyers

Potential short squeeze plays

Stocks on the Buy List turning higher

Energy stocks hanging by a thread

and more

Breakouts from big bases

AAPL above $183

It’s the biggest most important stock in the world and it is at 52-week absolute and relative highs. File that in the “not bearish” column.

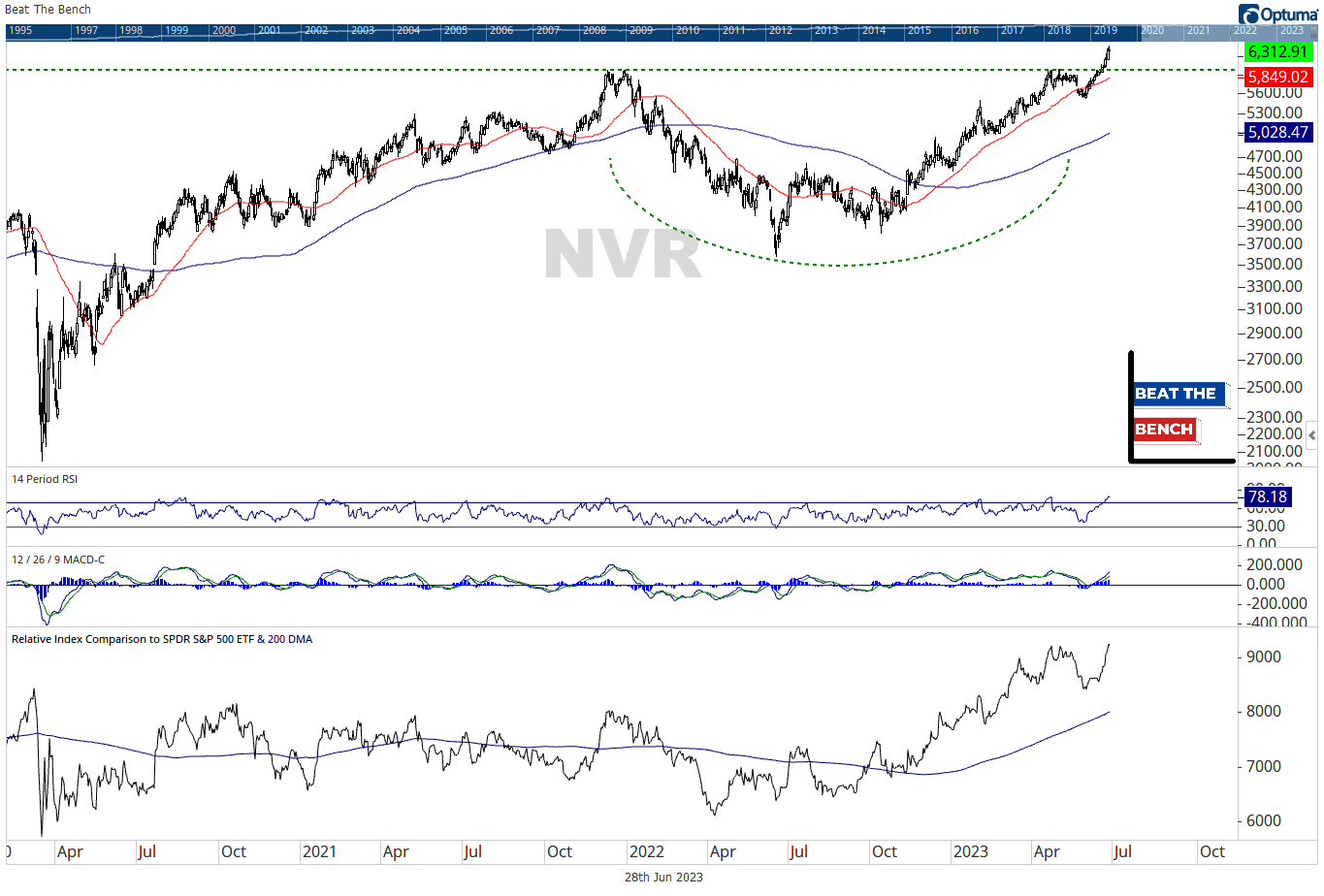

NVR above $6000

The MMP showed that homebuilder ETF flows may be getting extreme. But if NVR is above $6000, what’s not to like about this chart?

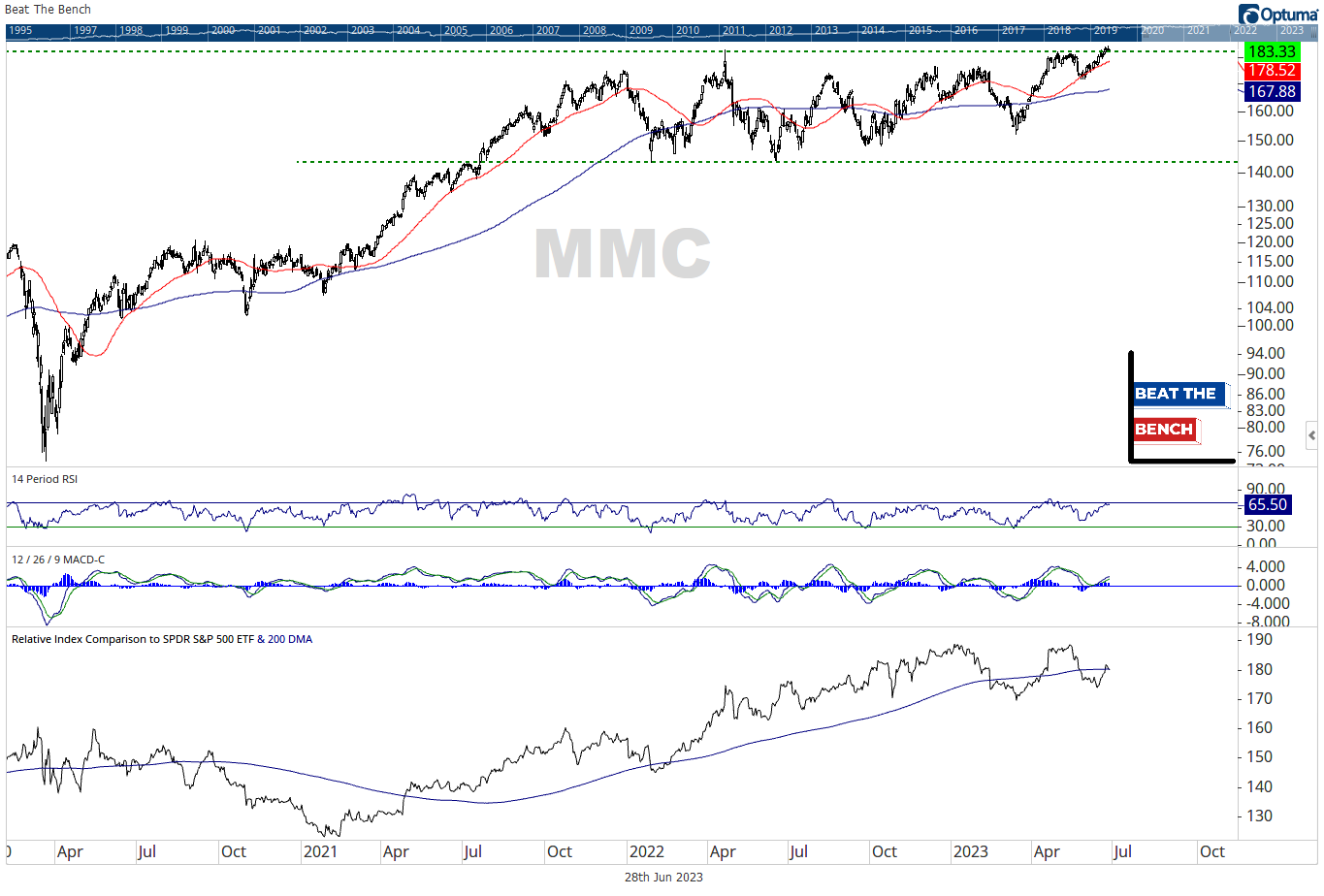

MMC breakout targets $223/share

A year-long rectangle for MMC has resolved higher, though the relative chart is losing some momentum.