Stocks: The Good, The Bad and The Ugly

Opportunities are growing, but where hasn't changed

Good morning advisors,

After two weeks off from this report, I’m happy to have it back. One point I neglected to mention in Tuesday’s deep dive into the bull case, is that each week when I prepare this report, the list of long opportunities has continued to grow, while the number of clearly attractive shorts has become fewer and fewer. In fact, we have to go back to November 9 to find a day that saw more than 2 stocks in the S&P 500 make new 52-week lows.

However, it is still a market to be extremely selective and you can add just as much value by making sure you don’t own some of the names that are trending lower or lagging as buying some of the stocks that are breaking out.

This week we will review:

52-week highs within tech

“Not so discretionary” discretionary still working

Top financials names

Software names that report earnings this week

Industrials ex-defense leaders

Coal stocks reemerging

What mega-caps are improving, and which aren’t

52-week highs within tech

IBM: International Business Machines

IBM stock hasn’t gone anywhere in 5 years and is lower over the past 10. However, things are different in 2022 and Big Blue is up about 8% and recently hit 52-week highs. I’d like to see it clear the 2020 highs near $152, but if you have to own tech stocks, IBM looks a lot better than most.

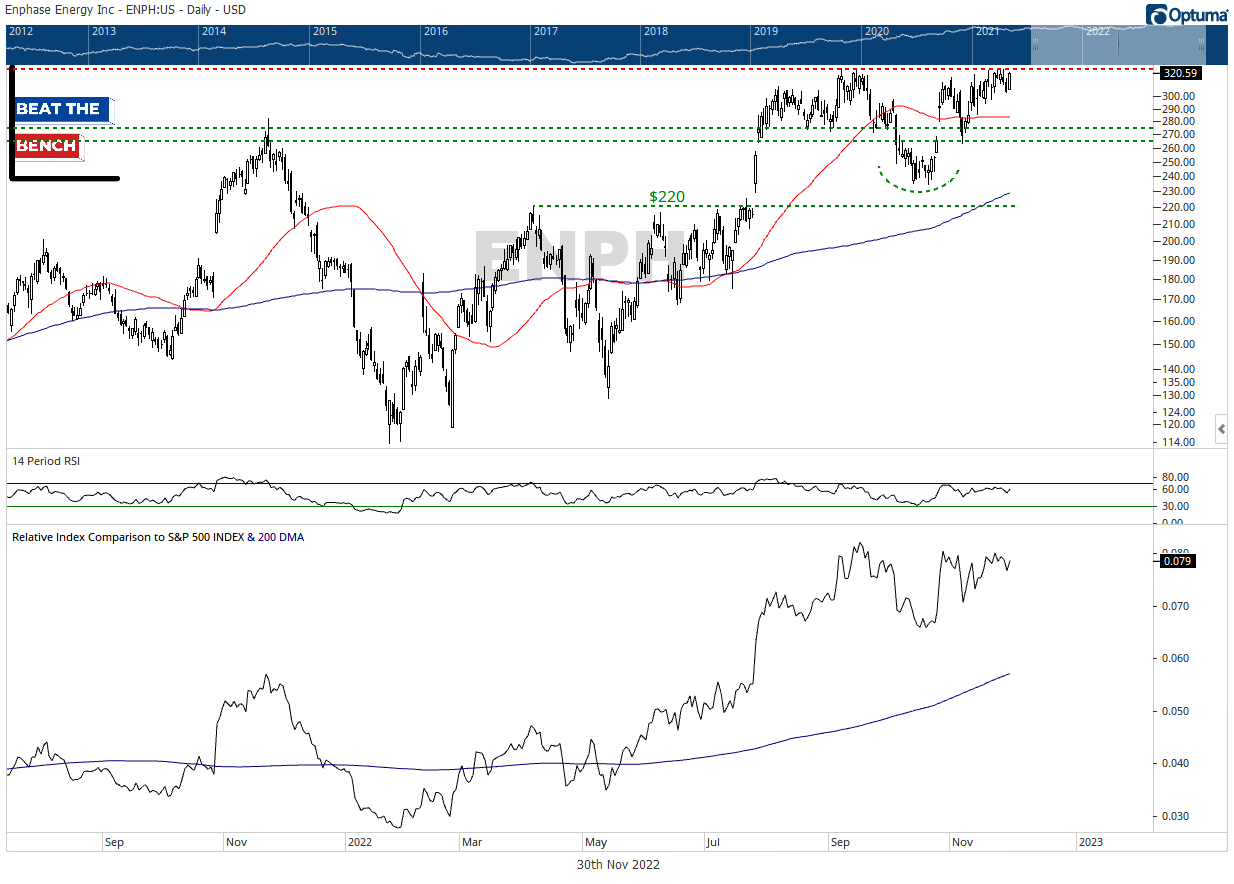

ENPH: Enphase Energy

Okay, technically Enphase hasn’t made a new 52-week high since September, but it was within a dollar on Monday so we’re counting it. RSI momentum is a bit underwhelming recently, but it continues to build a base here that I think is most likely to resolve higher. Above $325 is a breakout.

ADP: Automatic Data Processing

ADP has made a bad habit of selling off from each of its new 52-week highs over the past year but has continued to bounce back and is a clear relative leader. Keep this one on your watch screen as a pullback towards $230 would be an attractive entry point.

“Not so discretionary” discretionary still working

TJX: TJX Companies

TJX broke out from an 11-month base during our time off and ended last week above $80/share for the first time ever. $77 would be a conservative/tight stop for new money, while the 50-dma (currently at $70) would give this relative leader a bit more leash in the event of a broad market sell-off.

Keep reading with a 7-day free trial

Subscribe to Brown Technical Insights to keep reading this post and get 7 days of free access to the full post archives.