Stocks: The Good, The Bad and The Ugly

Are all sectors top heavy?

Good morning,

A major theme from 2022 that I believe is likely to continue is the top weights in the S&P 500 underperforming the “average” stock. However, this is primarily an indictment of a few select tech, discretionary and communication names, so I thought it prudent to see if this theme extends to other sectors.

Today we’re looking at the technical setup for the top 2 components (by weight) in each of the 11 S&P 500 sectors. Combined, the stocks account for 33% of the S&P 500, and comparing them against their own equally-weighted sectors will allow us to see if they are truly their sector’s top stocks in the current market environment.

Technology

AAPL: 21.7% of sector

Apple has climbed back above its June lows in the past week, but still looks like a broken stock. The stock is right up into resistance from the red broken support line and above that is the 200-DMA. Relative to its sector, AAPL has broken down and is sitting near 52-week lows.

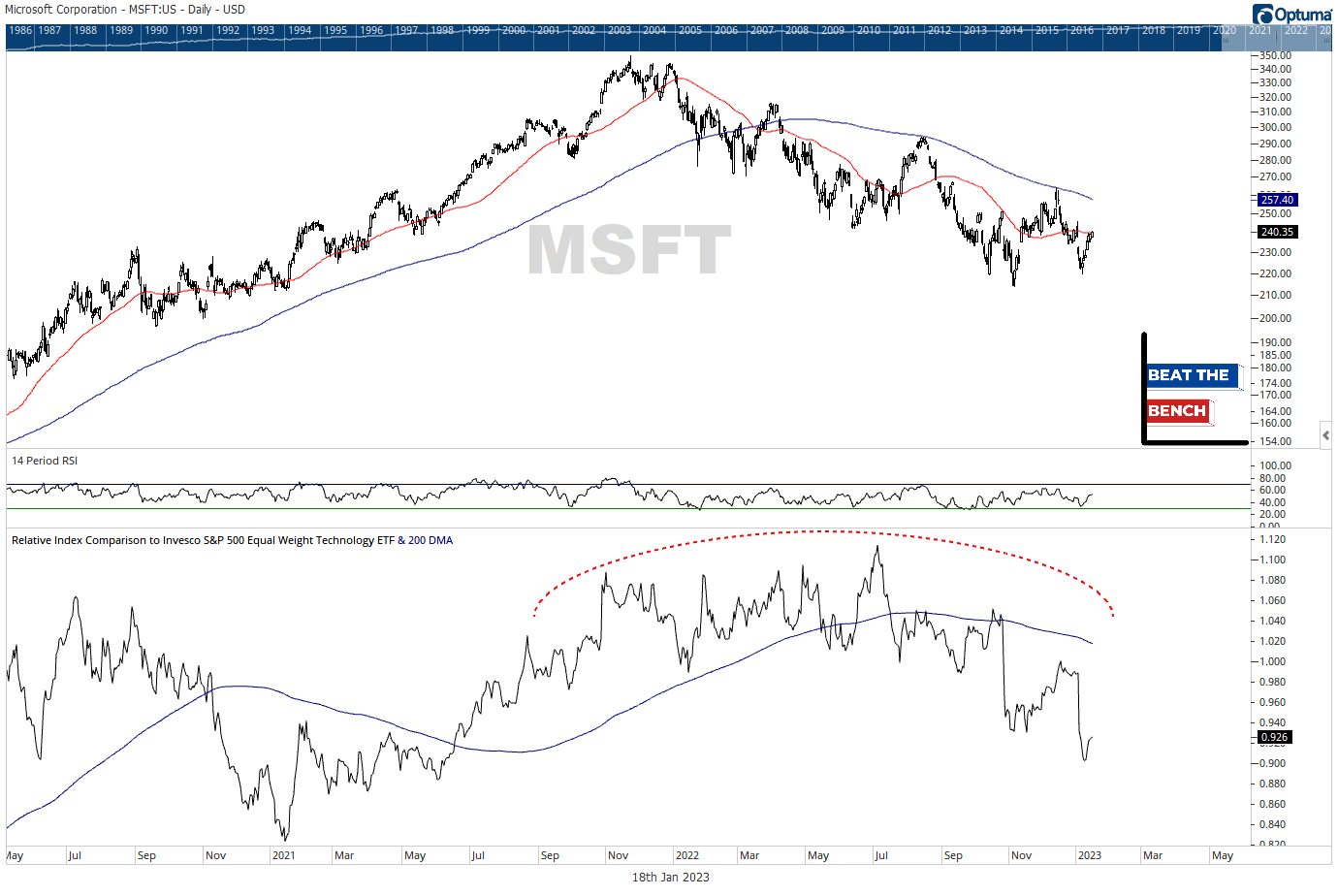

MSFT: 20.9% of sector

Relative to technology, Microsoft is also sitting near 52-week lows. The stock has carved out a higher low to start the new year and tactical support can be found at $219. Resistance at $257 and still a BAD stock until it can reclaim that 200-DMA.

Healthcare

UNH: 9.0% of sector

UNH is a broken stock and that could weigh on Dow returns in the near-term, because as a price-weighted index, UNH is the largest component. It failed to ever break through resistance near $560 and has now decisively lost the 200-DMA. Even in relative terms, the stock has turned. No longer look to UNH or any of the managed care stocks to provide leadership within healthcare.

JNJ: 8.9% of sector

JNJ stock topped out in April of last year in absolute terms and in June relative to the HC sector. You never want to have much conviction about the near-term direction of a stock sitting right on a flat 200-DMA, but the relative action suggests this isn’t a stock to be overweight.