Stocks: The Good, The Bad and The Ugly

52-week highs, banks ahead of earnings and other notable industrials

Good morning,

The major indexes suffered nasty reversals yesterday, but so far this week has seen far more stocks making 52-week highs than 52-week lows. We’ll take a look at some of the ones hitting new highs to see which look the most attractive and which are better to buy on a pullback.

We’ll also check in on the big banks ahead of earnings, and explore the technicals of other industrials stocks following Tuesday’s Deep Dive into the sector.

Let’s get into it!

52-week highs this week

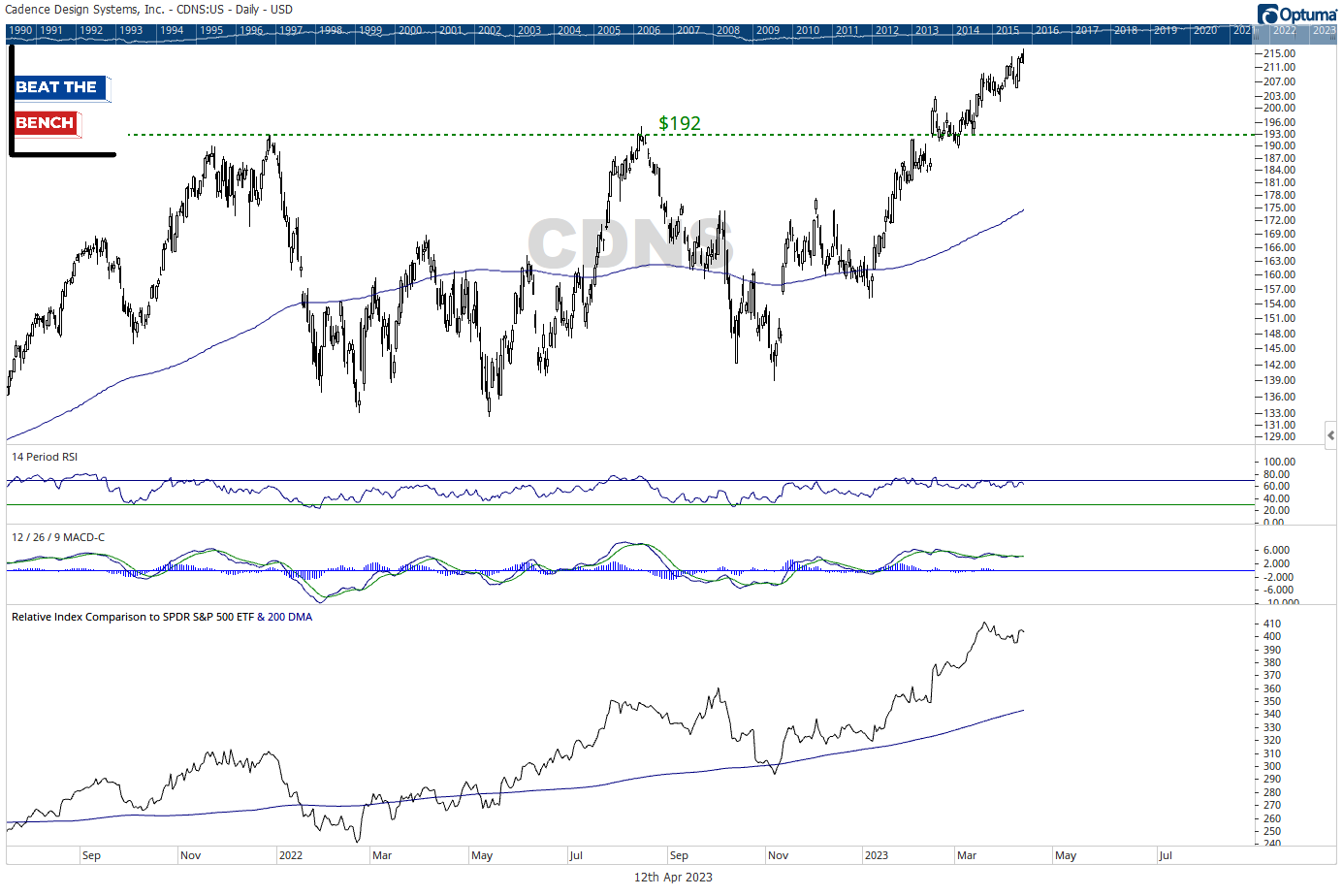

CDNS: Cadence Design Systems

CDNS has been as strong as they come, but the stock printed a bearish engulfing (or outside day) on Wednesday, just like the S&P 500 did. Pullbacks towards $192 should be viewed as buying opportunities.

LIN: Linde

Linde hit a new intraday high but has failed to make a new closing high. I don’t like to quibble too much with 52-week highs, but there is also a clear bearish momentum divergence that bears watching.

MCD: McDonald’s

MCD is the most overbought it has been since November, but if you are an intermediate-term investor, that is a good thing.

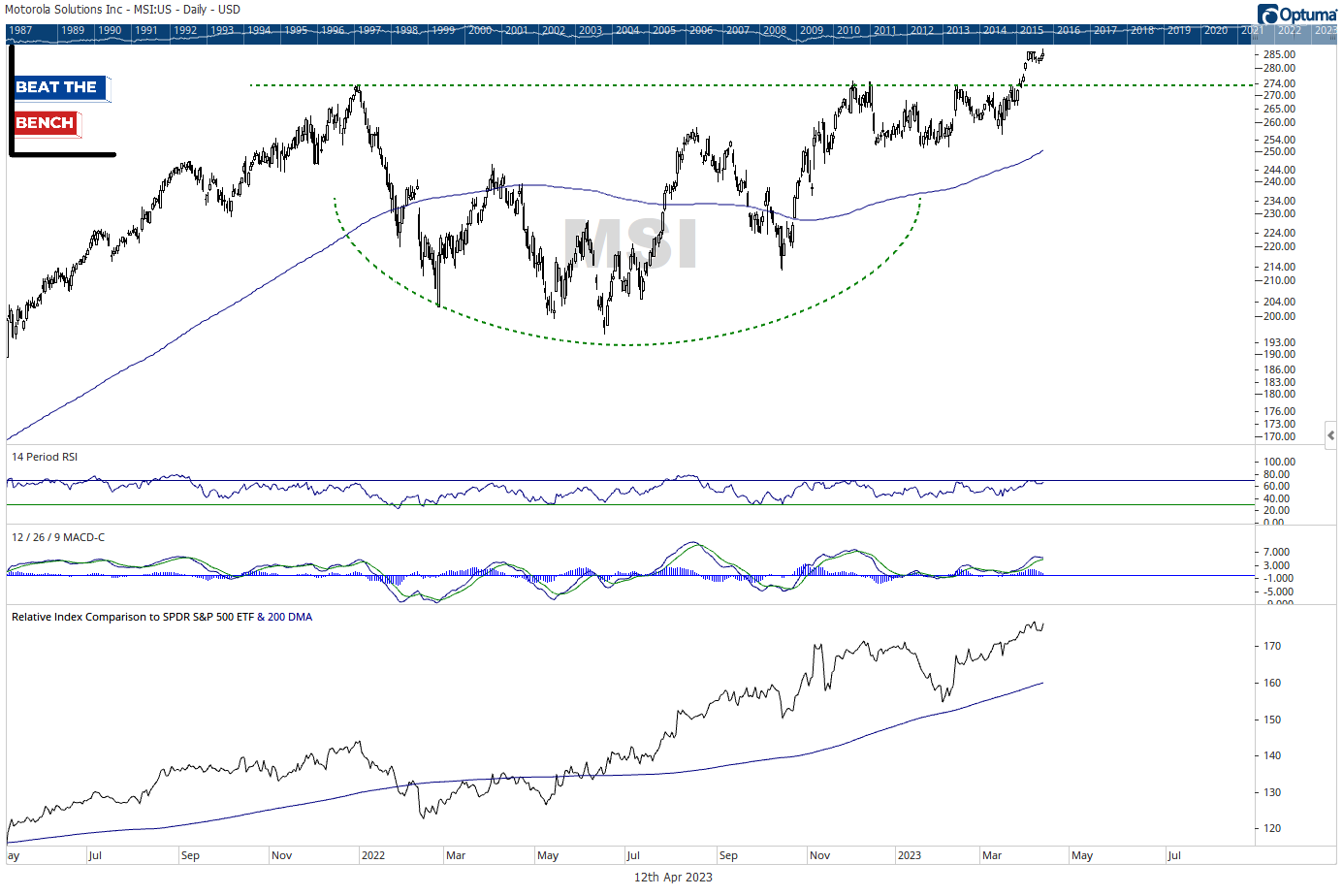

MSI: Motorola Solutions

New high for new Buy List addition Motorola Solutions. If above $274, long and strong.