Good morning,

We all know the famous Warren Buffet quote, “Only when the tide goes out do you discover who’s been swimming naked.” Well, it’s safe to say the tide has gone out in the past week and I think that provides a great opportunity to look at stocks through the lens of a real-life stress test.

This week we’re looking at:

The 5 worst S&P 500 stocks over the past week (they’re all banks)

The 5 worst non-financials in the S&P 500

The S&P 500’s 5 best-performing stocks since our last report

and a few other noteworthy charts

5 worst-performing stocks over the past week

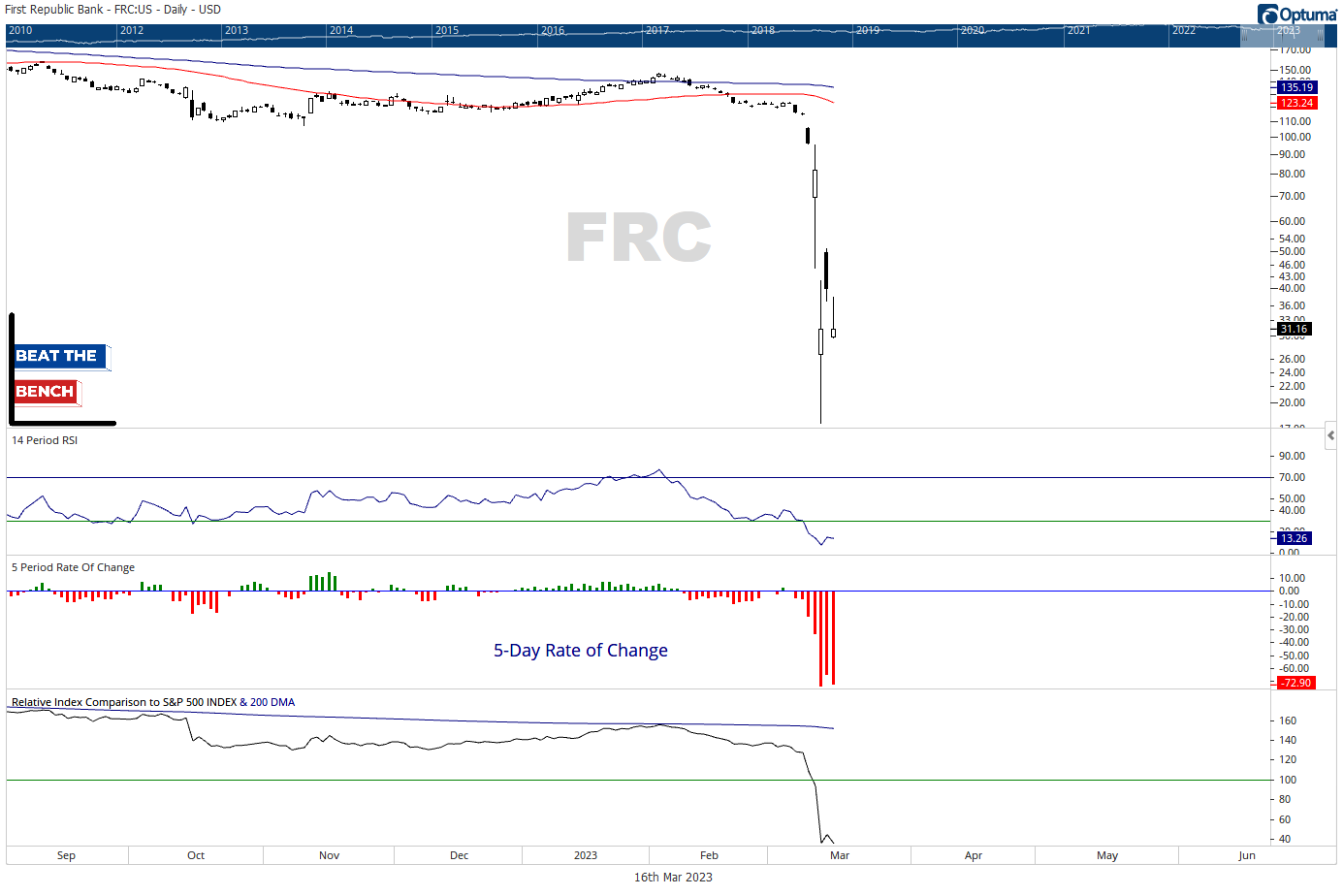

FRC: -72.9%

First Republic is everybody’s (including the market’s) favorite candidate to be the next to go under. Its 72% loss over the past week is twice that of the next worst stock in the S&P 500. There’s not much to say here on a technical basis, so I’ll just say that heroes are for comic books. Stay away.

ZION: -34.2%

ZION was featured in this report in December and last week and things were incredibly clear-cut at the $45 level. Once it broke, you just had to be out. ZION bounced at its Covid lows and now it looks like the most likely path is to carve out a base in the wide range from $23 to $45. Expect $45 to be big resistance in the future.

CMA: -33.4%

Comerica’s large head and shoulders top measured to $38/share once it broke support at $63 and it already hit that target. The stock has failed to recapture $49 multiple times this week, making that the first resistance to watch.

KEY: -32.1%

You still couldn’t pay me to touch this stock, but the levels are starting to get more well-defined. KEY has held its July 2020 lows ($10.90) twice on a closing basis this week, while first resistance is at the Tuesday intraday high of $13.74.

Keep reading with a 7-day free trial

Subscribe to Brown Technical Insights to keep reading this post and get 7 days of free access to the full post archives.