Stocks: The Good, The Bad and The Ugly

Earnings reactions, stretched industrials and software movers

Good morning,

Stocks have been under slight pressure this week, and through yesterday’s close, the S&P 500 is tracking to just its second down week of 2023. This year has so far been led by last year’s laggards, however, even those growthier areas of the market are beginning to look stretched on a short-term basis, furthering the case that February could continue its history of poor returns.

Nevertheless, the longer-term picture is more encouraging, with many growth stocks ending downtrends, and many of the cyclicals in a structurally good spot, just short-term overbought.

This week we will review:

Big movers that have reported earnings this week

Stretched industrials stocks

Software movers

A few stocks on my Buy List

Material stocks that look BAD

and more!

Earnings reactions this week

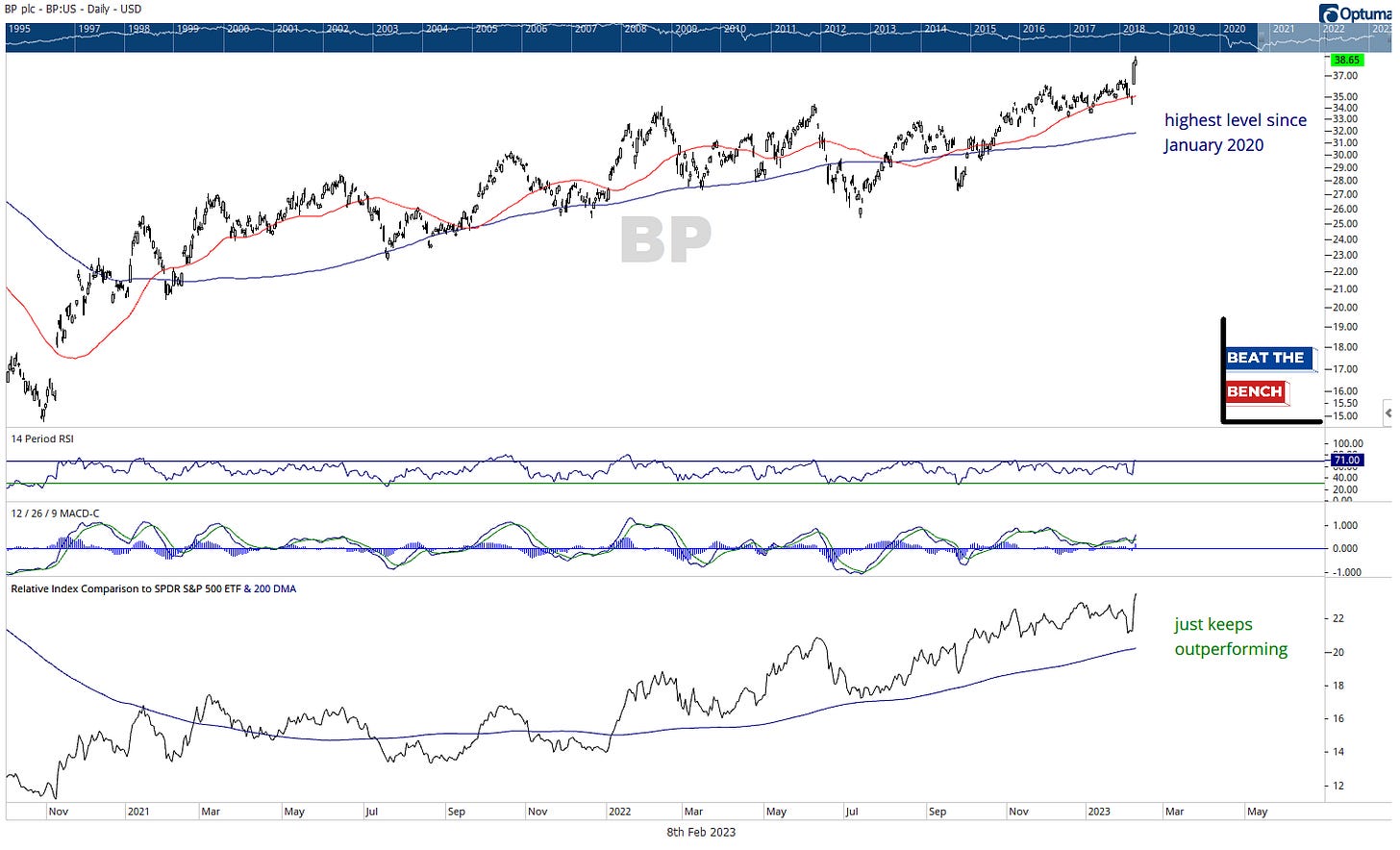

BP has not been notified of recent energy weakness

BP gained 8.3% on Tuesday following its earnings release that morning. That move easily sent the stock to a 52-week high, but more interesting is just how consistent the uptrend has been here in both absolute and relative terms, despite the weakness in the broader sector and with commodity prices.

Double miss for Chipotle may not be fatal

Chipotle sold off on Wednesday after missing on the top and bottom lines in its Tuesday earnings report. While that represents an initial failure to get through the September highs ($1,720-1,750), the stock found support at a key inflection point over the past few years. Given the stock’s relative strength, I’m inclined to view this as a buying opportunity using $1,620 as a stop.

Similar story for Under Armour

UA fell 8.4% yesterday after reporting earnings before the bell. However, the stock closed 3% off its lows of the day, bouncing right at the neckline of its completed inverse head and shoulders pattern. The measured move is to $13/share, almost exactly what would fill the gap from May 2022. I like UA for a trade on the long side using $9.40 as a stop.

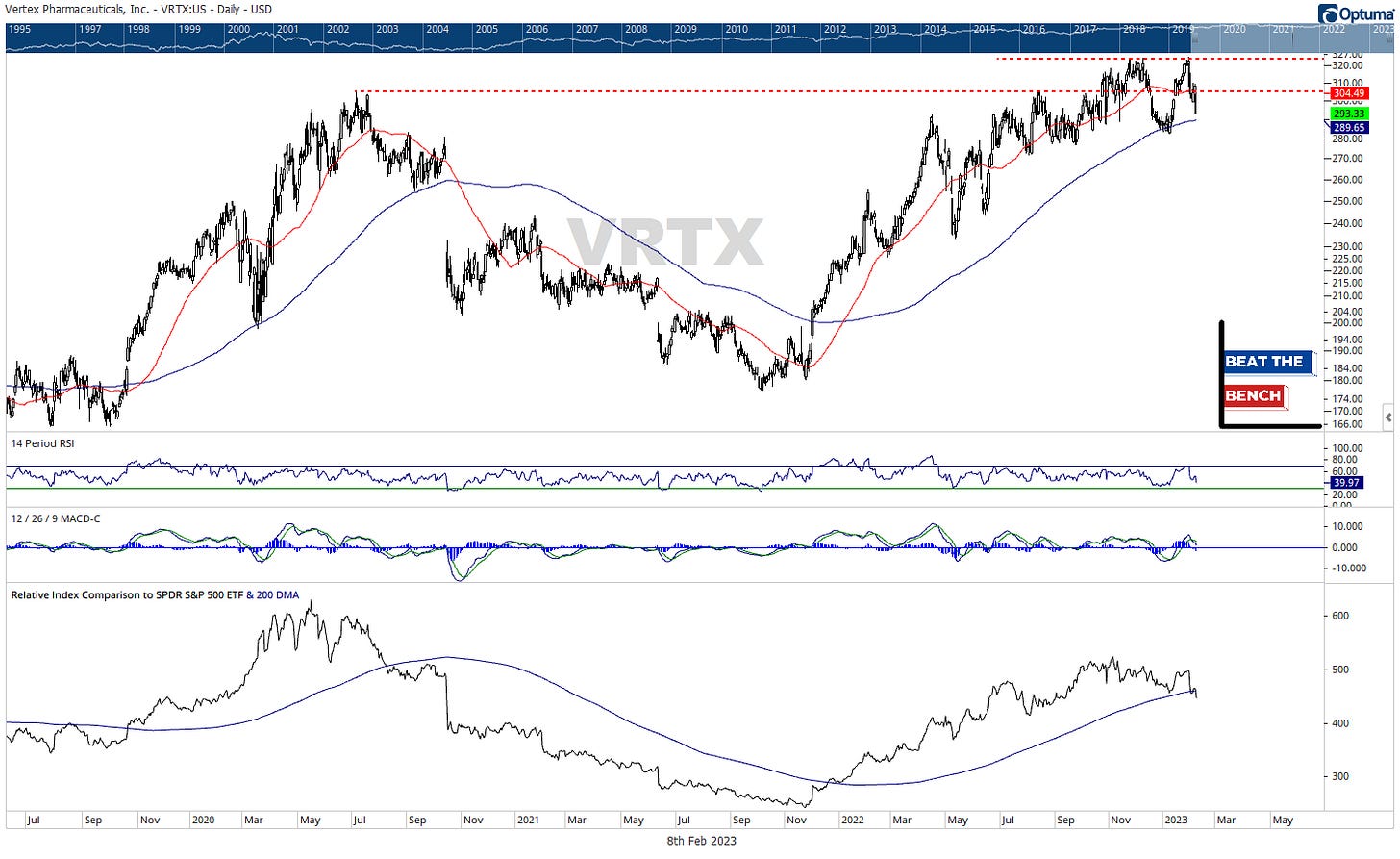

VRTX is fading

Vertex Pharmaceuticals fell 4.9% yesterday after earnings Tuesday after the bell. The stock hit a 52-week high as recently as as January 31, but this is looking like a short-term double top and a long-term failed breakout. The relative chart adds to the bearish technicals, falling below the 200-DMA vs. the S&P 500 for the first time since 2021.

Stretched industrials

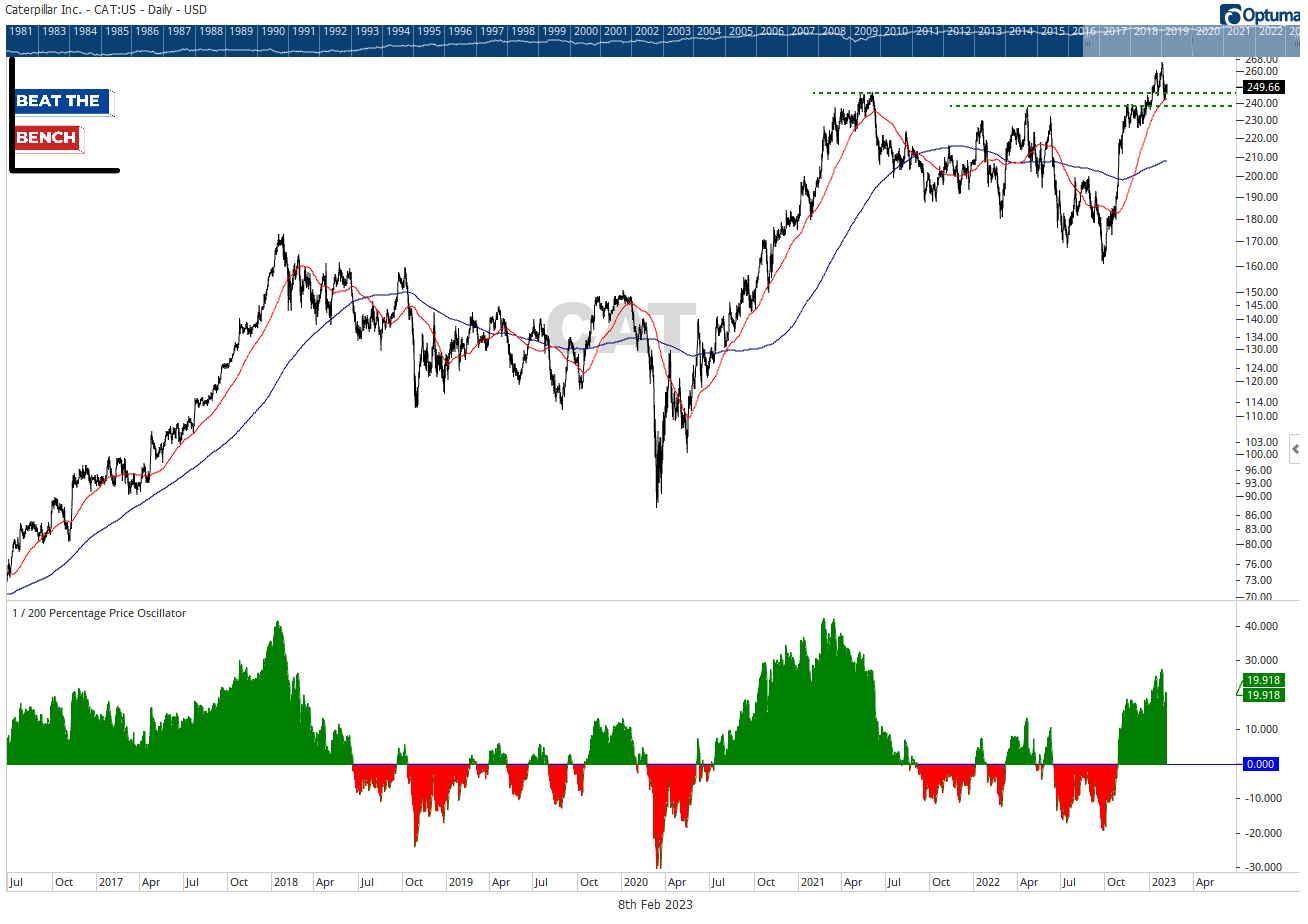

CAT still 20% above its 200-DMA

The following industrial stocks are great-looking bases and charts but tactically stretched enough to suggest that upside is limited in the near term. First up, Caterpillar, which is still 20% above its 200-DMA and was nearly 30% at the record high two weeks ago.