Stocks: The Good, The Bad and The Ugly

Observations in tech, healthcare names trying to break out and more

Good morning!

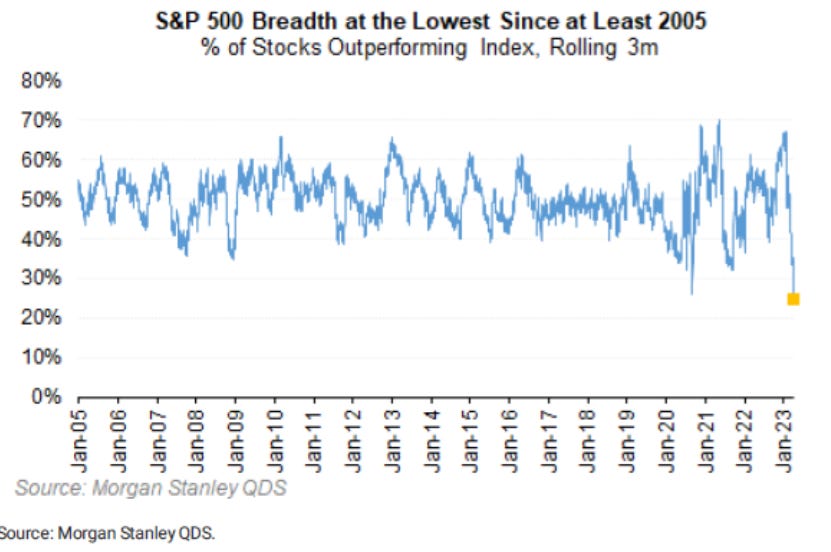

The major indexes remain a chop fest, but under the surface, there continues to be wildly divergent action. It’s definitely a tough environment for trend following, but really it has been a tough market for all stock pickers. In fact, this cool chart from Morgan Stanley was making the rounds earlier this week and shows that the past three months have seen the fewest percent of stocks outperforming the index since at least 2005!

Nevertheless, we can continue to stack the odds in our favor by focusing on uptrends, avoiding downtrends and lagging sectors, and trying to identify where the opportunities will be when this market finally does get going.

This week we are looking at:

Notable movers in the tech sector

Trouble with streaming stocks

Healthcare names trying to break out

Earnings reactions from major financial stocks

Energy not buying the oil bounce

and more!

Observations from the tech sector

Visa at an important spot

Visa is market leadership, which makes its date with $236 a potential tell or confirmation of what the S&P 500 does near 4200. Unfortunately, like the S&P, momentum is a bit underwhelming. A better buy at $238 than $232.

The last few MACD crosses haven’t been kind to MSFT

Microsoft continues to stairstep higher, but nearly all the MACD crossovers over the past year have led to corrections. First support is $276 followed by $246.

AAPL meets the downtrend line

Horizontal resistance is stronger and more noteworthy than diagonal lines, but the red one on Apple seems important. Not the place to be adding. Reports earnings on May 4.

PYPL still looks like it is bottoming

PayPal was on the inaugural Concentrated Equity Buy List back in January, but was sold in early March for a 3% loss. That was the right move as the stock has lagged the market since then, but the original buy thesis is still intact. This looks like a base/bottoming pattern for patient investors, but the relative strength just isn’t there.