The Deep Dive

Sector Review

Please note, The Deep Dive will not be published next week. Next week’s Monday Morning Playbook will be released Tuesday, May 30 at 6 am ET. Yesterday’s report incorrectly referred to Tuesday as the 29th.

Good morning,

This week we’re reviewing the 11 S&P 500 sectors. This is something I like to do on a regular basis, and even though the last review was only two months ago, with the S&P 500 breaking out I think it is more important than ever to be aware of the character of this rally.

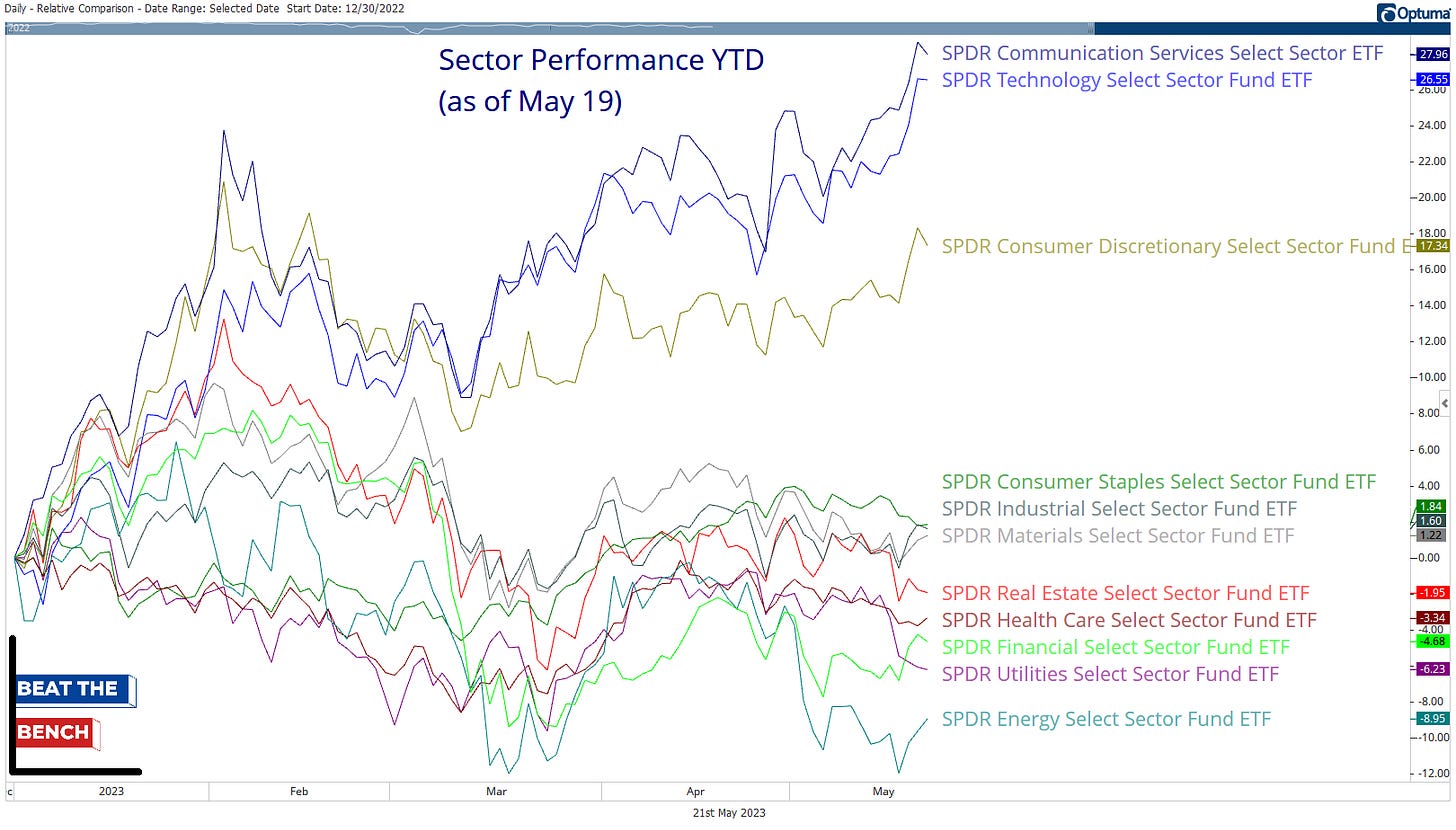

Above are the year-to-date sector returns as of this weekend, and you don’t need a technical chart to see where the leadership is. However, today’s report will aim to provide an update on all the sectors, and I think it is especially important to focus on the absolute setup of the bottom 8 sectors to see if they are showing signs of turning higher along with the leaders.

Let’s find out!

XLC: Communication Services

% of stocks above 200-DMA: 54%

Communication services has the weakest breadth of the three leading sectors, but that doesn’t necessarily matter for the technicals of XLC as long as META and GOOGL continue higher. XLC has now broken through the neckline of its second inverse head and shoulders pattern, the larger of which targets the $72 level. It shows no signs of giving up leadership, making fresh 52-week relative highs.

XLK: Information Technology

% of stocks above 200-DMA: 75%

The tech sector has broken out to 52-week absolute and relative highs in the past two weeks. While it is overbought short-term, $151 can now be viewed as support for XLK. The sector has the strongest breadth of any sector and history suggests tech is more likely than not to remain leadership over the intermediate-term.