The Deep Dive

Berkshire Hathaway

Good morning,

The 2023 Berkshire Hathaway annual shareholder meeting was held this past weekend, and while I no doubt share a very different investing style than Warren and Charlie, I love the nuggets of wisdom that they always have to share. Of course, there are plenty of investment-related quotes, but this one especially stuck out to me:

You should write your obituary and then try to figure out how to live up to it.

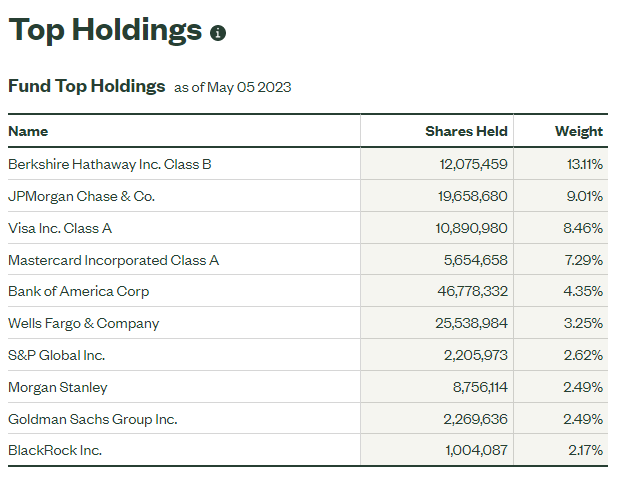

So, I thought this week it would be appropriate to do a deep dive into Berkshire, including the technicals for the stock, as well as the equity portfolio’s top holdings. Now, Berkshire has very different goals and a very different time horizon than I think most investors do, but if what they see and the technicals line up, then maybe there’s something special there.

Let’s dive in!

The Stock

BRK.B is the largest weight in the financials sector

Berkshire Hathaway is the top holding in the financials sector, at a more than 13% weight. Note, that recent additions to the top of XLF include Visa and Mastercard, which were recently moved from the technology sector and have also helped to dampen the impact of the regional banking crisis.

The stock recently hit 52-week highs

Berkshire hit a 52-week high last Monday and that accompanied a breakout above year-long resistance at $320. The stock pulled back the rest of the week but bounced strongly off that level last Thursday. The MACD has crested, indicating there could be near-term pressure on the stock, but overall this is a stock that looks technically strong and provides an attractive entry point to investors that wish to use $320 as a stop.

BRK.B relative to XLF

As you likely could have guessed, Berkshire’s performance relative to the broader financials sector has been incredibly strong recently. The stock has outperformed its sector by more than 17% over the past 3 months and hit an all-time relative high vs. financials just last week. While this isn’t a trend I would fight, the recent highs did show a slight bearish momentum divergence, suggesting near-term, the sector may be able to bounce back relative to BRK.B.