The Deep Dive

Sector Review

Good morning,

This week we’re doing a sector review. Yesterday’s Monday Morning Playbook managed to cover technology and energy, but with so much going on, a technical update on the standing of each sector seems prudent.

The sectors below are ordered based on their YTD return, and shown are the traditional cap-weighted sectors using the SPDR ETF family.

Let’s dive in!

Technology: +15.34%

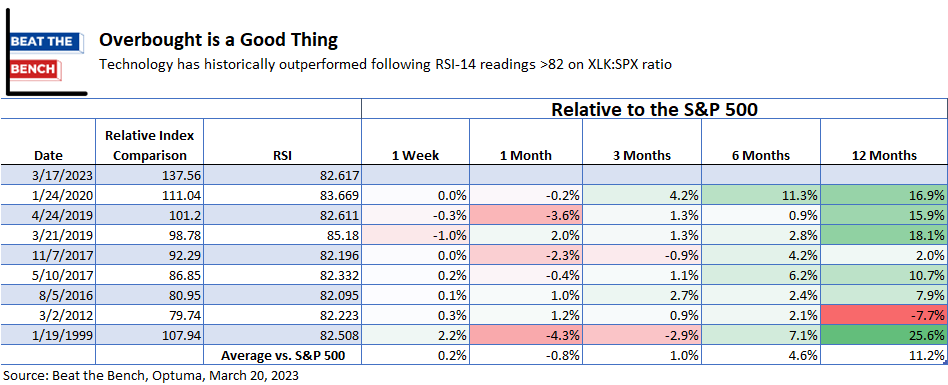

XLK was rejected at the $145 level I called out yesterday. However, the relative leadership surge is no joke. A daily RSI of 82.8 (relative to the S&P 500) is extremely overbought, but I ran the numbers below and it is what we tend to expect from daily overbought readings. Over the next month, tech is more likely than not to lag, but 6 months later it has never underperformed the S&P 500. Uptrends get overbought, downtrends get oversold.

Communication Services: +15.17%

XLC completed one inverse head and shoulders pattern and is now working on another. Recent lows at $51 are tactical support, while a move above $60 is needed to complete the second H&S and target $75/share. In relative terms, the group has ended its downtrend and is just 100 bps of outperformance from making a 6-month relative high.