The Deep Dive

The Bull Case

Good morning advisors,

As promised yesterday, today’s edition of The Deep Dive will be Part I of a quick series where we explore the strongest charts in support of a bull market for equities. Beat the Bench remains cautious on equities and positioned defensively relative to benchmarks, but I think it is important to test those beliefs and play devil’s advocate. Next Tuesday, we will look at The Bear Case, but for now, here are the most compelling reasons I can find to expect equities to move significantly higher.

Textbook market bottom with new low divergences

Perhaps the strongest argument for the S&P 500 having made its cycle lows is (so far) most stocks bottomed back in June. And it isn’t just that. The slight undercut of the June index lows with this bullish breadth divergence is exactly what we were looking to see. Don’t believe me? Here is a blog I wrote back during the COVID crash looking for this exact scenario.

QQQ holding the line

It may not feel like it, but the chart above makes the case that the sell-off we have seen in QQQ is really just a correction within a long-term uptrend. The trendline that goes back to the GFC lows is still intact and the tech-heavy ETF is still up about 11% since it bounced off this line in October.

Key indexes have now eclipsed their 200-dma

Growth stocks and specifically the largest ones have been the weakest part of the market in recent months. But if you look at major indexes that don’t have as much exposure to FANG, FAANG, FANNMG, GAAMA or whatever they are calling them these days, things don’t look nearly as bad. The Dow Jones Industrial Average, equal-weight S&P 500 and Russell 1000 Value Index have all eclipsed their 200-day moving averages in the past month.

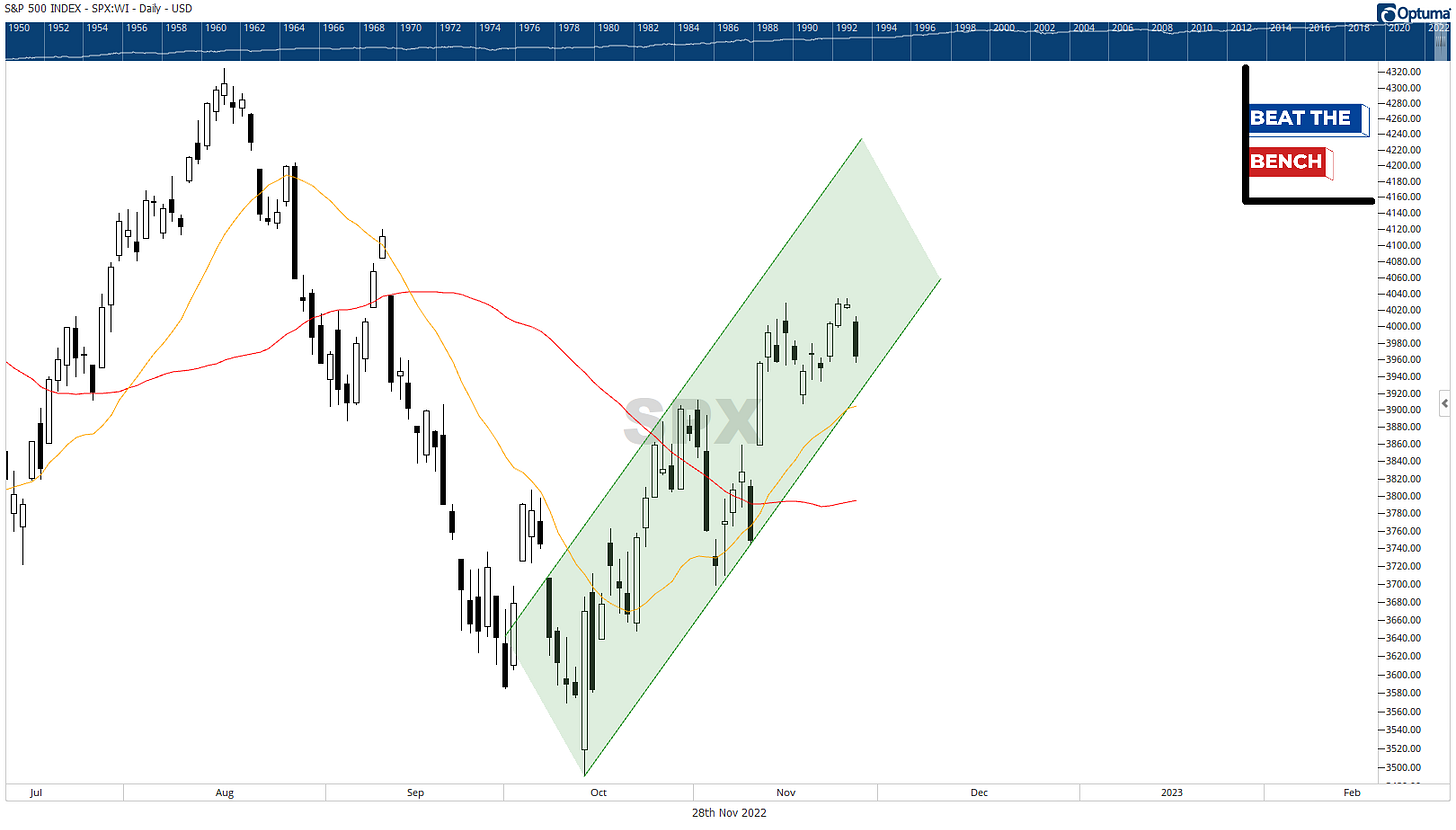

Trend channel from October lows still intact for S&P 500

Okay sure, the S&P 500 isn’t yet to its 200-dma, but if you take a shorter-term view, the index is still in a well-defined uptrend channel going back to its October lows. This could be tested this week, but until it breaks it is hard to be too negative.

Short-term breadth surge, long-term breadth improvement