The Deep Dive

1st Half Recap

*Reminder that Beat the Bench is off next week for summer vacation. The regular publishing schedule will resume on July 24.

Good morning,

Today’s Deep Dive is a comprehensive recap of the first half of 2023. I hope that the technical perspective is helpful for client conversations, letters, and general color on what actually happened in the market during the first six months, rather than what the news or financial press may choose to focus on.

Today’s report will review:

Performance across equities, fixed income, and commodities

Sell-side forecasts gone wrong

The most important technical stories from the first six months

Let’s dive in!

Performance Recap

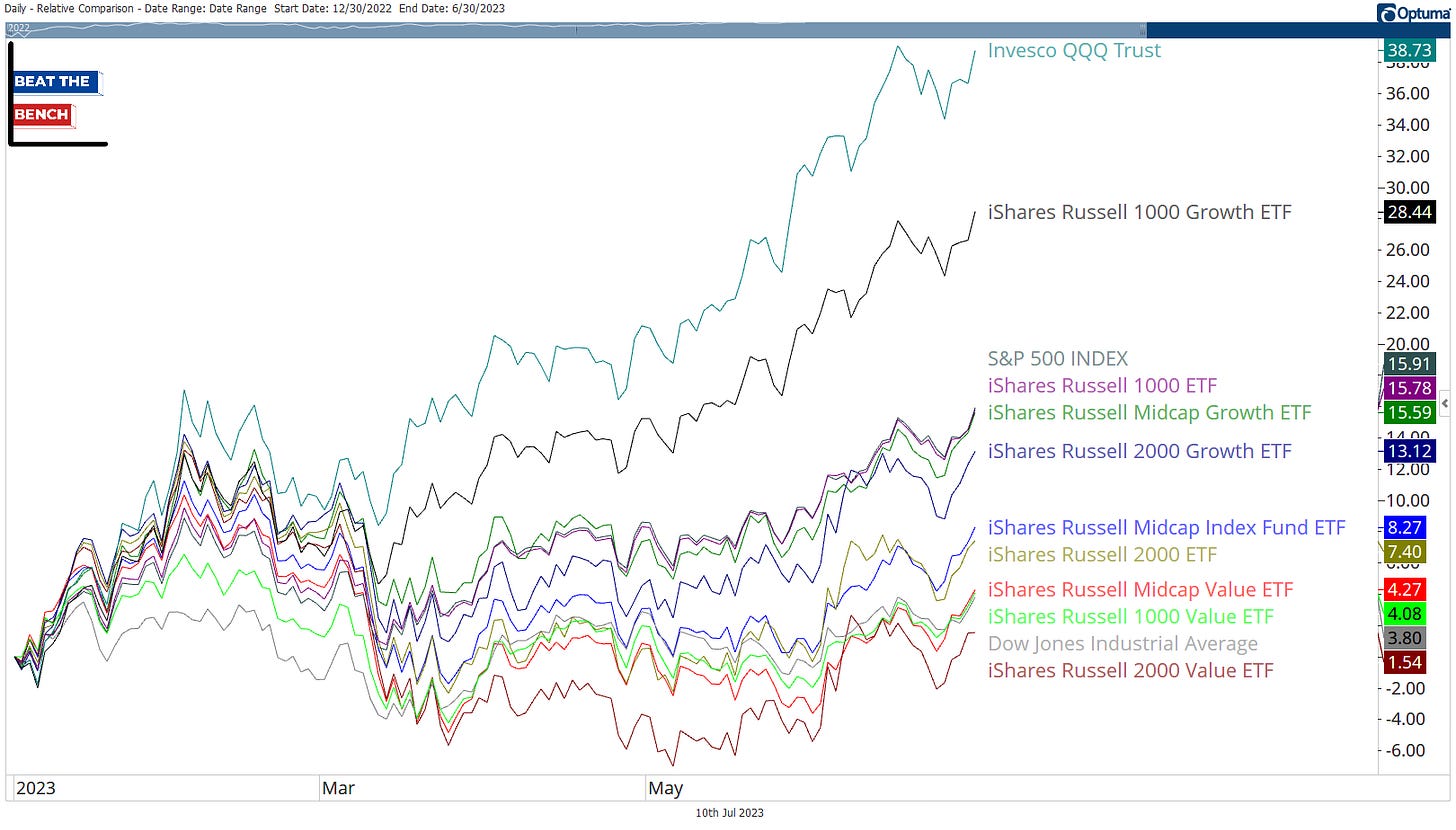

Major Indexes and Style Boxes

Despite pervasive rumors of “only five stocks going up” all 9 boxes in the Morningstar style box were positive during the first half of the year. Small-cap value, dragged lower by the regional bank crisis, was the clear laggard up just 1.5%, while the large-cap Russell 1000 Growth ETF gained more than 28%. The split was even wider within major US large-cap indexes, as QQQ (the Nasdaq 100) outperformed the Dow Jones Industrial Average by 35%.

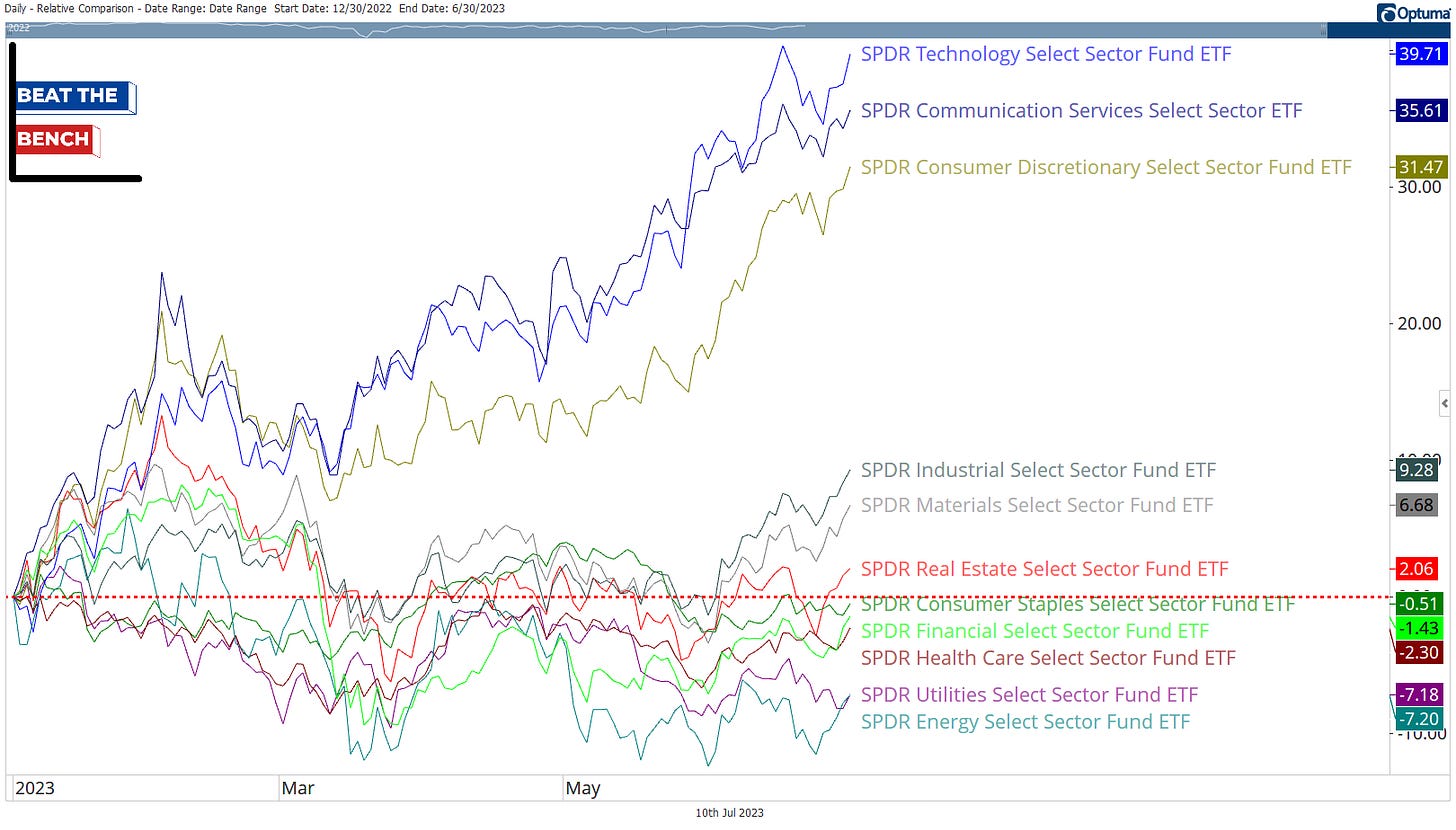

Sectors

That disparity was even more pronounced at the sector level. 3 of the 11 S&P 500 sectors gained more than 30%, while 5 were outright negative during the first six months. The good news is that even on this chart you can see the laggards starting to play catch up in June.

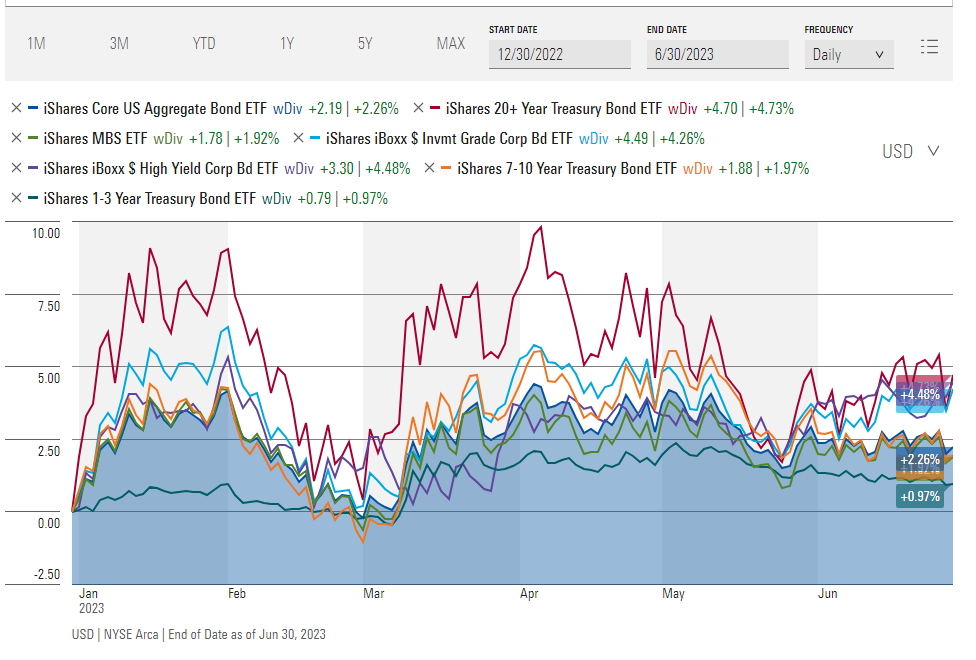

Fixed Income

Fixed income investors experienced a far more pleasant start to 2023 after 2022’s historically negative year. All major fixed income asset classes experienced positive returns, with long-term Treasuries (+4.73%) just edging out high-yield bonds (+4.5%) for the top spot. Short-term bonds (+1%) were the laggard for the first half but did outperform in Q2 as interest rates moved higher.

Commodities

Gold certainly didn’t perform as well as the S&P 500 or Nasdaq, but its 5.2% return was better than the Dow Jones Industrial Average, the small-cap Russell 2000 or any major asset class within fixed income. It was especially strong relative to commodities which were broadly lower in the first half of 2023. Nat gas looks to have bottomed in April, but still ended the half down nearly 40%.

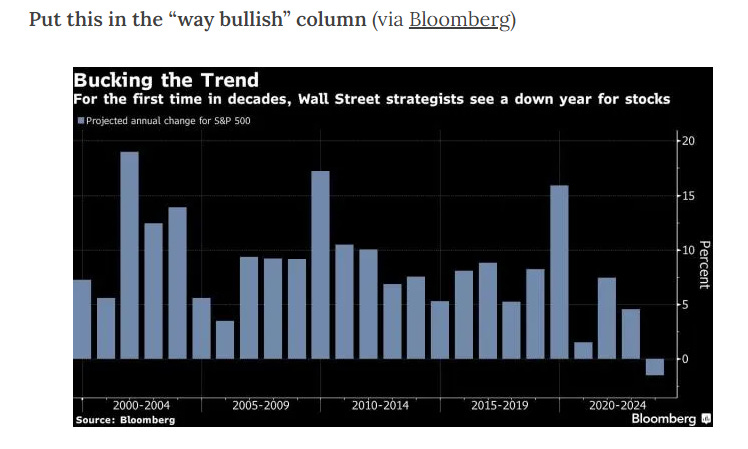

Fundamental strategists swing and miss

Year ahead forecasts

Coming into this year, consensus forecasts from top Wall Street banks were for a down year for the S&P 500. As I noted at the time, this was extremely bullish because strategists had never forecast a negative year and almost always trot out the same mid-single-digit forecast every single year, even though that rarely happens.