The Deep Dive

Healthcare

Good morning,

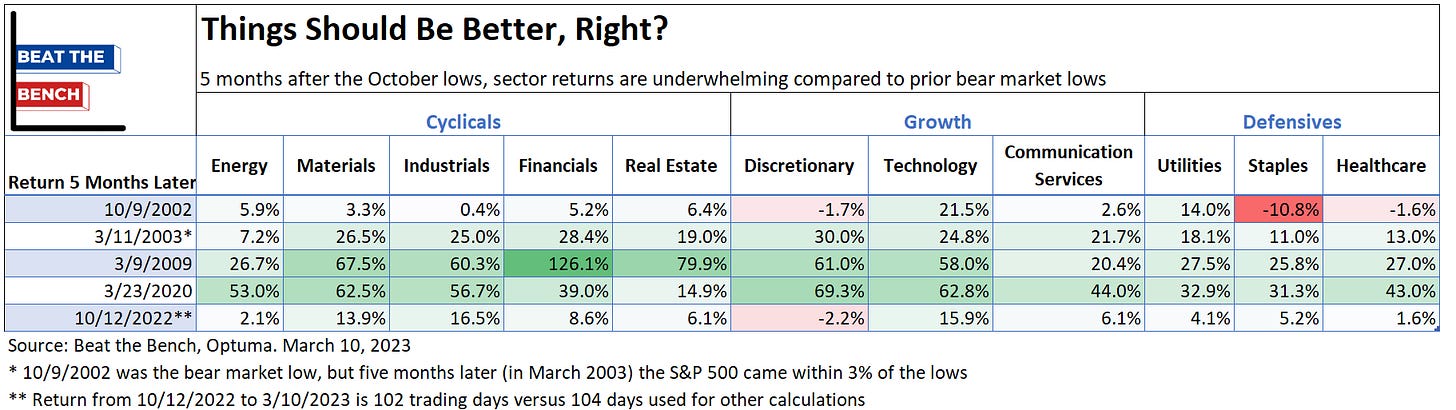

This week we’re doing a deep dive into the healthcare sector. Healthcare’s dramatic fall was the original inspiration for this chart, which showed that all sectors, whether cyclical or defensive, are usually dramatically higher five months from a major bear market low.

As it stands now, healthcare is just 6% above its closing low from 2022 (which was technically made back in May) and trailing the S&P 500 return by nearly 10% YTD. However, even if the sector isn’t leading, at a 15% weighting it is the second largest sector in the S&P 500 and a diverse sector worth a closer look.

This week we will look at

The absolute and relative technicals of XLV

Market internals and sentiment

Key ETF sub-groups

and leaders and laggards at the individual equity level

Let’s dive in!

Top Down

Big picture: Rangebound despite recent decline

Healthcare has been going nowhere fast since way before it was cool. This is despite a recent 9-week losing streak that was by far the longest in the history of the XLV ETF, including the 3 prior bear markets. The 18% range has support near $118 and resistance just above $140/share. From a structural perspective, this looks more like a base than a top, but the very important pharma chart we will see later makes me a bit worried. No reason to be too wedded to a view until the range breaks.

Tactical view: Testing downtrend channel resistance

On a more short-term basis, XLV’s daily momentum is turning up from extreme oversold conditions but has significant resistance in the 2% above Monday’s close. The next 2% higher would require overcoming:

Monday’s intraday high

Downtrend channel resistance

The 50-DMA

The 200-DMA

All in all, that makes it a tough place to consider adding here.

XLV relative to the S&P 500

Keep reading with a 7-day free trial

Subscribe to Brown Technical Insights to keep reading this post and get 7 days of free access to the full post archives.