The Deep Dive

The Consumer Discretionary Sector

I think I'd say we're in an environment where it's kind of odd, which is very strong consumer spend. You see it in our numbers. You see it in other people's numbers, up 10% prior to last year, up 35% pre-COVID. Balance sheets are very good for consumers. Credit card borrowing is normalizing, not getting worse. So you go in a recession, you've got a very strong consumer.

-JPMorgan CEO Jamie Dimon, October 14, 2022

Good morning, and welcome to another edition of The Deep Dive!

This week, I’m tackling the consumer discretionary sector. Jamie Dimon may or may not be right about the state of the US consumer, but don’t tell consumer discretionary stocks. CD is the second worst performing sector over the past year (-27.22%) and is a sector that the Beat the Bench Sector Allocation remains firmly underweight.

The sector has macro implications, huge important stocks, and a large number of industry-specific ETFs for advisors to add value with. So, let’s dive in and see what is happening under the surface of the S&P 500’s fourth largest sector.

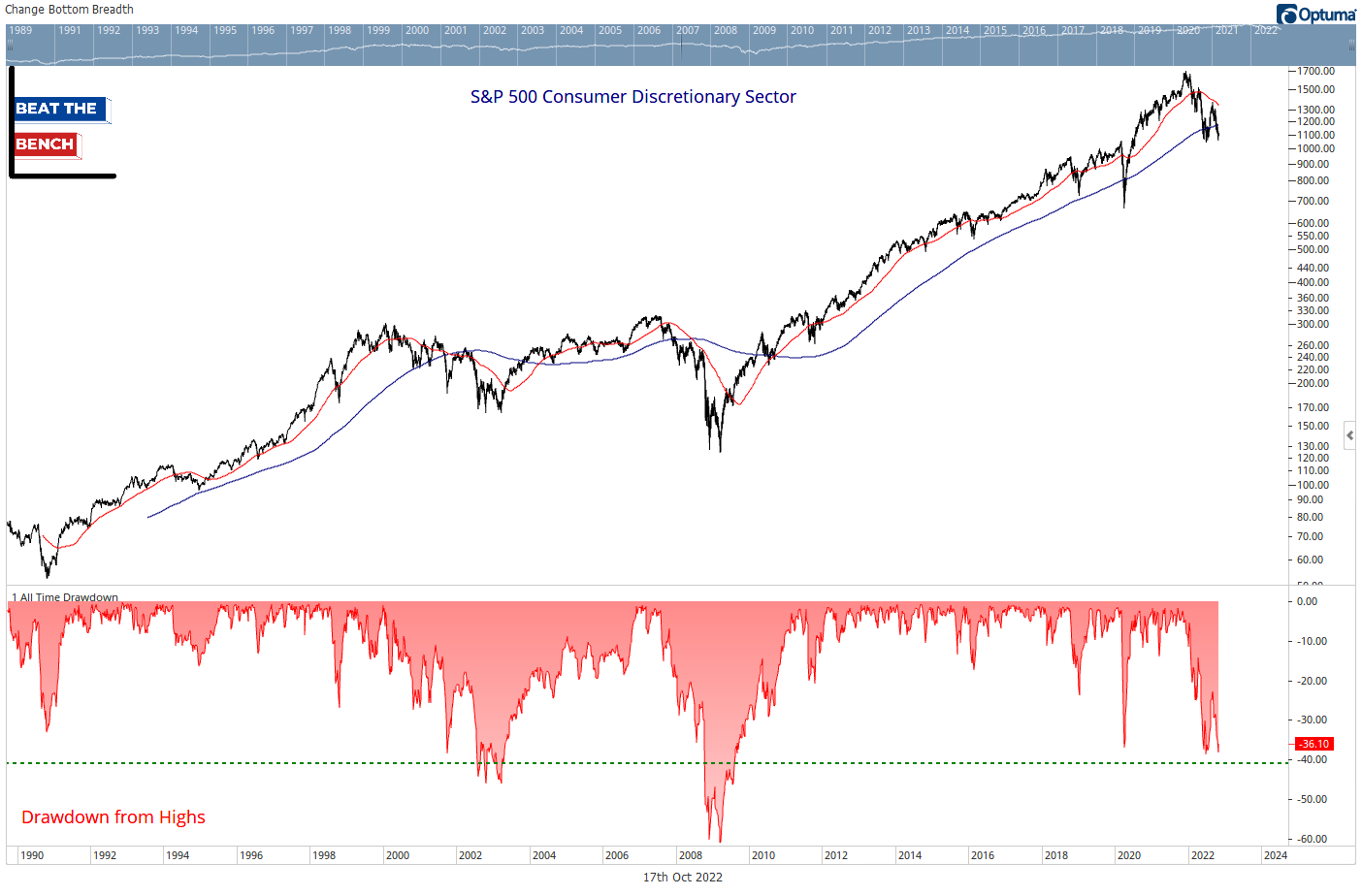

Big picture look

The S&P 500 Consumer Discretionary Sector is currently 36% below its all-time highs from November 2021. Its 38% max drawdown this cycle was exactly on par with the drawdown from early 2020. Price is currently below its 200-week moving average, a metric we are closely monitoring on the S&P 500.

Tactical view (XLY: SPDR Consumer Discretionary Select Sector Fund)

The trend here simply isn’t good, but that doesn’t mean there aren’t reasons for optimism. $133 represents a confluence of key support levels, and it is no coincidence that this is where the sector has chosen to make its stand over the past four months. We have held this level again in recent days, and the daily MACD shown in the bottom panel is on the verge of flipping positive.

Enthusiasm must always be reined in when it comes to downtrends, but there is a clear trade here for those with aggressive tastes: Put new money to work using $133 as your stop. First target would be $154, while the 200-dma is key resistance (note that arrows and key turns over the past few years).

Relative to the S&P 500

Performance relative to the S&P 500 has been volatile, but the trend still leans negative below a downward sloping 200-dma. However, the sector has outperformed the S&P 500 by about 10% since late-May and is bouncing at minor support.

Beat the Bench remains underweight the sector

The charts above represent not only a key risk-on vs. risk-off indicator in my macro work, but a pair trade that the Beat the Bench Sector Allocation currently has on:

Underweight Consumer Discretionary/ Overweight Consumer Staples.

The first edition of The Monday Morning Playbook had fortuitous timing, as September 19 marked the most recent top in this ratio. Staples have outperformed discretionary by 6.8% since.

For now, the outlook still favors staples. However, I expect (read: need) to see this turn higher at a major market low and would expect to close this trade out when we add equities to the Balanced Allocation and increase the Beta Barometer. A higher low here would be a start.

Underperformance vs. staples suggests a recession is on the horizon