Good morning,

This week we’re checking in on ETF flows. Three months ago when I first featured flows, it was one of the most well-received reports of the year. And I think this will be especially timely amid the recent signs of rotation.

As a reminder, we want to view ETF flows through a contrarian lens because they act as a sentiment indicator.

When we look at a chart and see extreme inflows in recent months, the question becomes, can we actually see more? Same thing when we see lots of outflows. If we’re seeing multi-month or multi-year outflows, sentiment is likely flushed, and the weak hands are out. Flows (and potentially price) have only one direction to go.

Just like our last report, we’ll highlight ETFs that fall into one of 3 categories:

Overly aggressive. These ETFs have seen extreme inflows. For an uptrend, I don’t believe that alone is a reason to sell but it’s a yellow flag and could indicate more downside vulnerability in a correction.

Contrarian positive. These ETFs have seen significant outflows recently and extreme readings could indicate selling is unlikely to continue to the same degree. Potential tailwind if a downtrend can stabilize and a bullish indicator for uptrends or ETFs breaking out.

Apathetic. Flows here aren’t extreme in either direction but that means there could be room to run for the underlying trend.

Overly aggressive

Investors can’t get enough of the Mag 7 ETF

This 15-month-old ETF doesn’t have enough history to be scientifically robust, but anecdotally, you can see flows have gone parabolic in recent weeks. The fund has taken in almost half a billion in the past 3 months as investors have chased what was the only thing working.

QQQ just saw highest reading in the past 20 years

As of Friday, QQQ had taken in over $14 billion in the trailing 3 months, the highest reading since 2001. Still, they’ve been consistently high for the past year and it hasn’t stopped the Nasdaq 100 yet.

Most inflows for SPDR Utilities ETF in 2 years

When we looked at utilities in the April report, utilities were in the “contrarian positive” section, with their highest level of outflows in over a decade. Sure enough, XLU rallied 11% over the next 5 weeks. But now, we want to avoid the group. Relative performance has rolled over to multi-month lows and inflows are the highest since July 2022.

Too much optimism toward European financials?

EUFN is a decent chart, above a rising 200-DMA and just a month removed from a 5-year high. But I was surprised to see the highest level of inflows since February 2022. Sentiment wasn’t the catalyst then, but it sure didn’t turn out to be a great time to invest.

Investors love the Argentina story. Maybe too much

Argentina has a great story with a libertarian, free-market president after years of socialist policy. And the chart is still in a strong uptrend. But these small, country-specific ETFs don’t usually do a lot of volume (see 2021-2023) and ARGT has consistently been over a $100 million in net inflows in recent months.

Contrarian positive

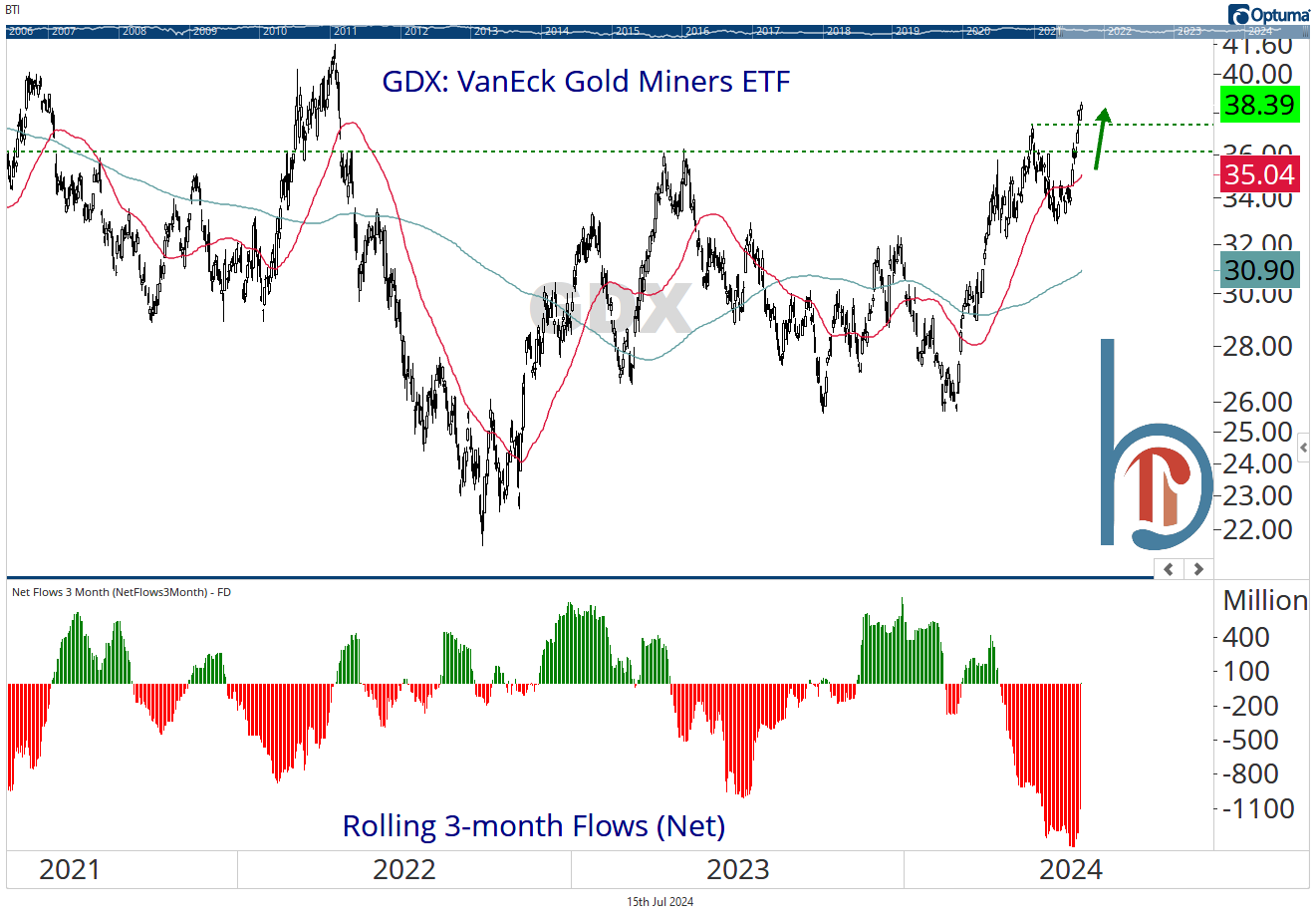

Investors are selling gold miners as it breaks out

GDX is breaking out to 2-year highs and investors have yanked more than $1 billion from the fund in the past 3 months. This is an ideal setup from a buyer’s perspective.

Keep reading with a 7-day free trial

Subscribe to Brown Technical Insights to keep reading this post and get 7 days of free access to the full post archives.