Overtime

Tech sector focus

Good morning,

Since the April lows, no sector has been better than technology. In fact, of the 11 SPDR ETFs, Tech is outperforming the next-best sector (industrials) by nearly 10%.

That matters, not just because technology is the largest sector in the S&P 500 (at a staggering 33% weight) but because coming into the year, and before the April lows, there were a lot of reasons to be negative about the sector.

Today, we’ll look at what’s changed and how investors can profit from it.

We’ll review:

The top-down technicals

Breadth and seasonality

The 3 stocks that move the cap-weighted sector

And six of the best large-cap tech charts

Top-down

VGT is closing in on all-time highs

Down 30% from all-time highs just two months ago, VGT is now just 3% away. $649 was strong resistance for three months at the turn of the year and we could see some digestion here. But late May saw a successful retest of the 200-DMA, and last week saw a short-term breakout, so my base case is that new all-time highs are in the cards before we see any material downside.

The real story is relative

Coming into March, the poor relative trends and absolute vulnerability of the tech sector were a big reason we went underweight equities in models in March and April. However, things have changed since the April lows and we need to respect the improvement. Tech just hit a 3-month relative high and is back above the 200-DMA vs. SPX, something that has been a critical trend marker over the past few years. Investors should have at least benchmark levels of exposure (33.5% of S&P 500) to the tech sector and arguably more.

And this isn’t just about those top stocks. The equal-weight tech sector just broke out vs. the equal-weight S&P 500.

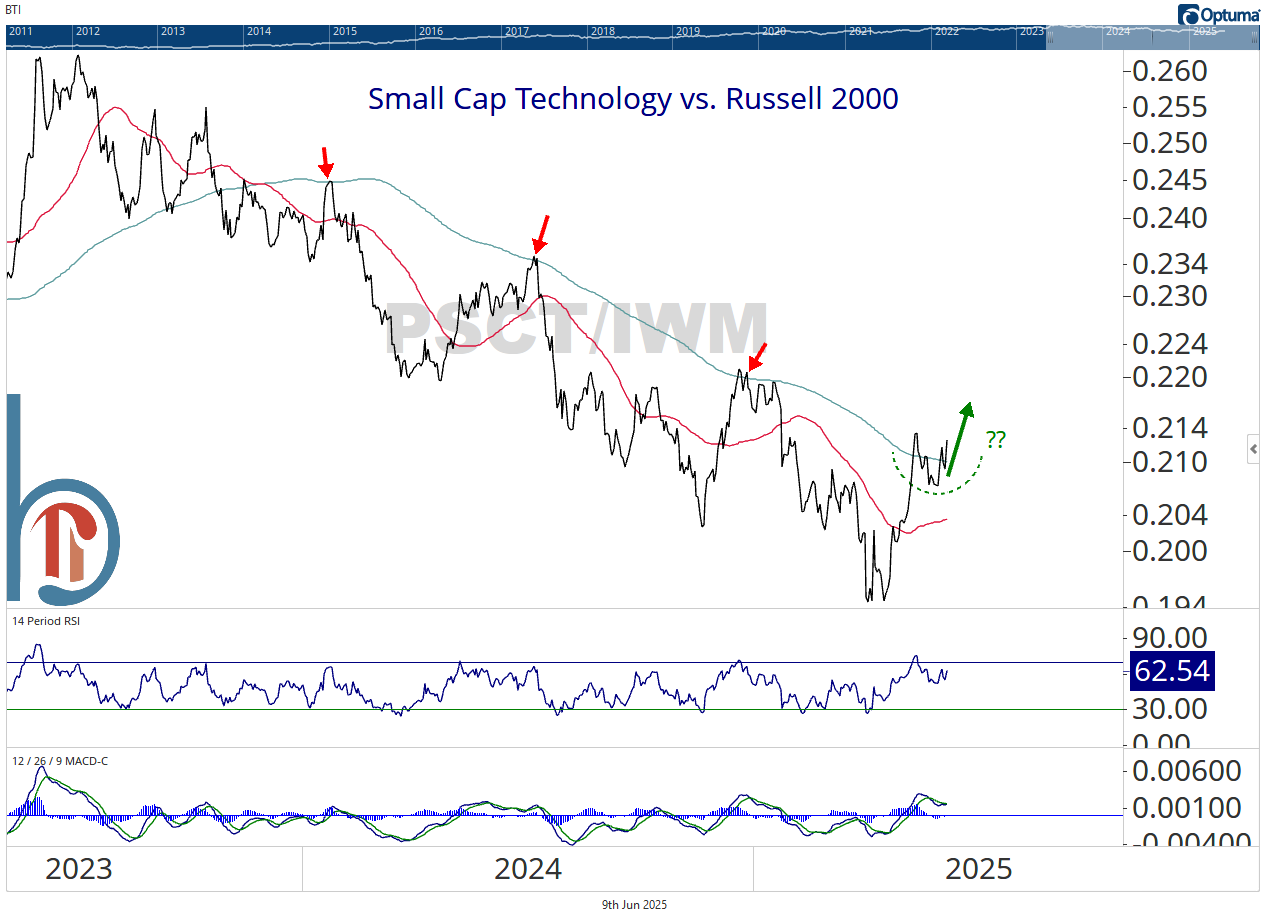

And small cap technology is trying to reclaim the 200-DMA vs. the Russell 2000 for the first time since the fall of 2023.