Overtime

Real-time earnings update and preview

Good morning,

Overtime has always been a wild card report, allowing us to cover what needs to be covered. And with the big banks kicking off earnings season today, as opposed to the normal Friday schedule, it seemed an opportune moment to provide a real-time update on how the market is digesting those calls.

Of course, CPI also came out this morning, so we’ll provide an update on how the market is reacting there as well.

Today’s report will review:

Major index and interest rate reactions to CPI

Big banks’ early morning moves following earnings

A technical preview of other notable earnings reporters later this week

Let’s get into it!

CPI reaction

CPI reports in line with expectations

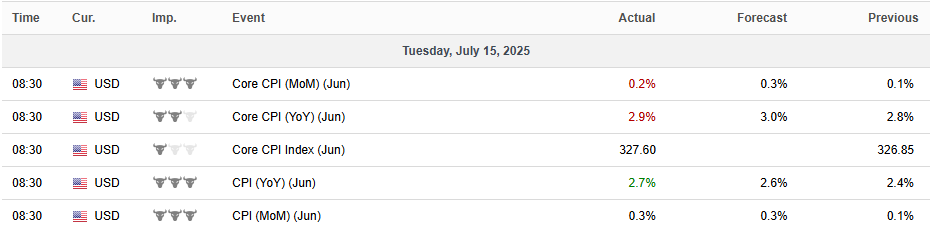

June CPI came in in line with economists’ expectations, with the core reading 0.1% softer than expected year over year and the headline number 0.1% hotter. As shown below, the market is reading this as a non-event.

Futures don’t move on the CPI report

S&P 500 futures were up modestly this morning ahead of CPI and sat at the exact same level an hour after the 8:30 ET release.

Looking at the cash index as of 11:15 ET, we can see that the index attempted to breakout above 6285 (this week’s level to watch) but that breakout attempt failed. We’ll look to see if the index can regroup and find support; 6252 and 6237 are the first downside levels to watch.

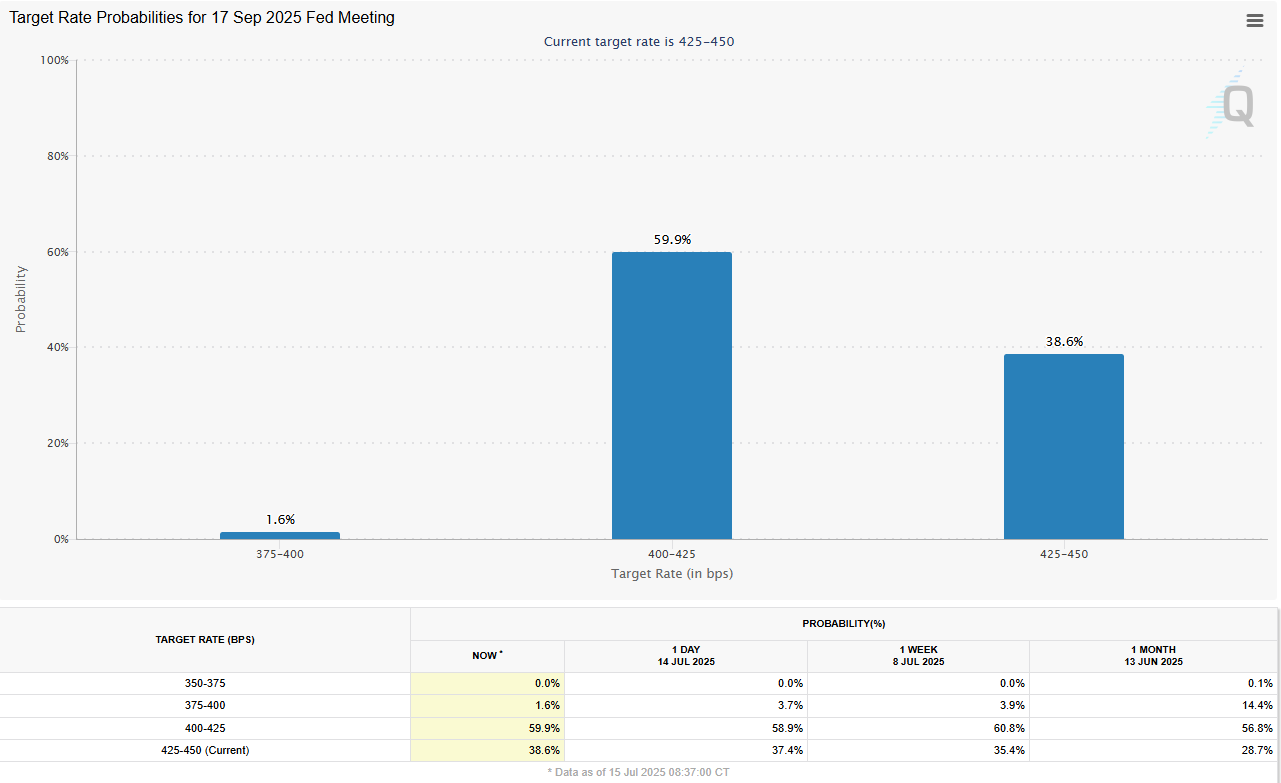

Fed fund futures unchanged

Fed fund traders’ expectations for a September cut were unchanged following the inflation report. They remain at a 60% chance of a cut.

30-year yield breaking out

While the initial reaction was muted, two hours into trading and the 30-year yield is at session highs and above the 4.98% breakout point called out in yesterday’s report. 5.15%, the 2023 and May 2025 highs, is now in play.