Overtime

ETF Flows

Good morning,

This week’s Overtime is on ETF flows. It’s only been about two months since our last update, but we’ve seen one of the biggest whipsaws in market history in those two months, so I think we’re due for another update.

A reminder that we look at flows as a sentiment indicator, and like all sentiment indicators, we want to view them with a contrarian lens.

Just like our previous reports, I’ll highlight ETFs that fall into one of 3 categories:

Overly aggressive. These ETFs have seen extreme inflows. For an uptrend, I don’t believe that alone is a reason to sell but it’s a yellow flag and could indicate more downside vulnerability in a correction.

Contrarian positive. These ETFs have seen significant outflows recently and extreme readings could indicate selling is unlikely to continue to the same degree. Potential tailwind if a downtrend can stabilize and a bullish indicator for uptrends or ETFs breaking out.

Apathetic. Flows here aren’t extreme in either direction but that means there could be room to run for the underlying trend.

Let’s get into it!

Overly aggressive

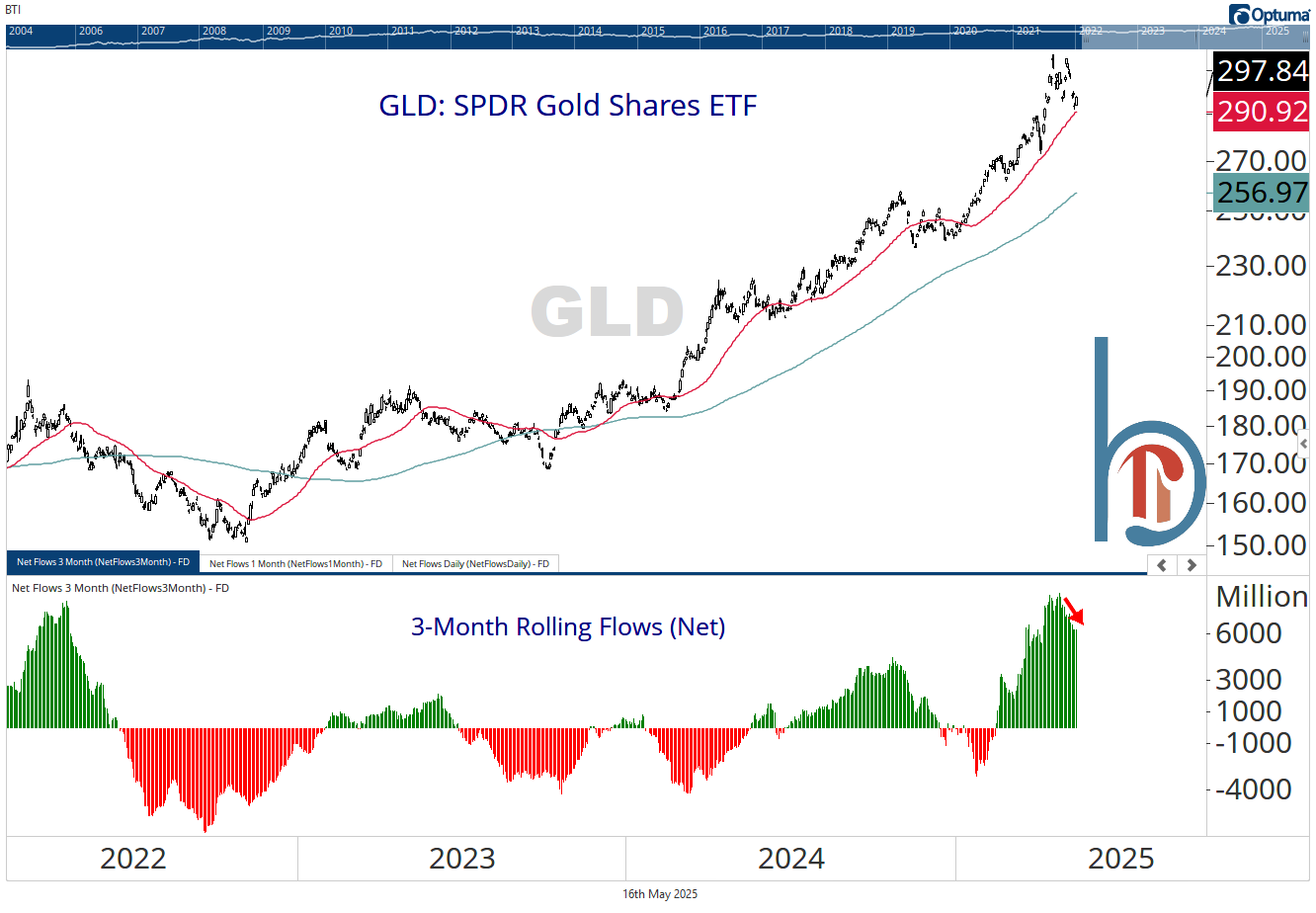

Gold

Gold is finally starting to see some outflows over the past two weeks but the trailing 3-month number remains at its highest level since the early 2022 peak. Rolling 1-month flows just flipped negative, and I believe we see more outflows before we want to give gold another look from the long side.

Europe (IEV) and European financials (EUFN)

This is the primary reason we didn’t add foreign equities to the ETF models at the beginning of the month. The trends here are strong but investors clearly became too consensus on European stocks outperforming, just in time for US stocks to play catch-up over the past few weeks.

This section is short for a reason!

Every few months when I do this report, I go chart by chart and look at rolling 1 and 3-month flows for all bond, sector, industry-focused, and international ETFs in my chartbook. And gold and Europe are the only two places really flashing optimistic extremes. The lack of aggressive inflows across the US equity complex supports further price gains and suggests investor sentiment has room to get much more bullish before sentiment becomes a risk again.

Not extreme but noteworthy that low vol is seeing inflows amid the rally

Finally, while not extreme, I think it fits nicely with the paragraph above that SPLV is seeing more money come in over the past month, despite lagging the market substantially. This tells me that investors don’t really buy the rally and are opting for more-defensive exposure rather than reading the message of the market. If you’ve been following along that message is: The lows are in, breadth thrusts suggest more gains over the next 12 months, and aggressive growth stocks are leading.