Overtime

Consumer staples

Good morning,

Today, we’re taking consumer staples into Overtime.

It might seem silly to focus on the most defensive sector with arguably the worst relative trend following yesterday’s surge to start the week, but our job is to skate to where the puck is going, not where it is.

Like healthcare when we looked at all the way back in August, consumer staples has a bad relative trend. But by some metrics, we’re entering “so bad, it’s good” territory, and that deserves a closer look. Healthcare, oh by the way, has been the second-best sector since that report on August 19, and the only one besides technology to outperform the S&P 500.

Today, I’ll break down everything you need to know about the sector, including:

Top-down technicals

Breadth

Flows

Key relative trends

Focused ETFs

Noteworthy single stock charts (long ideas + ones to avoid)

Top-down technicals

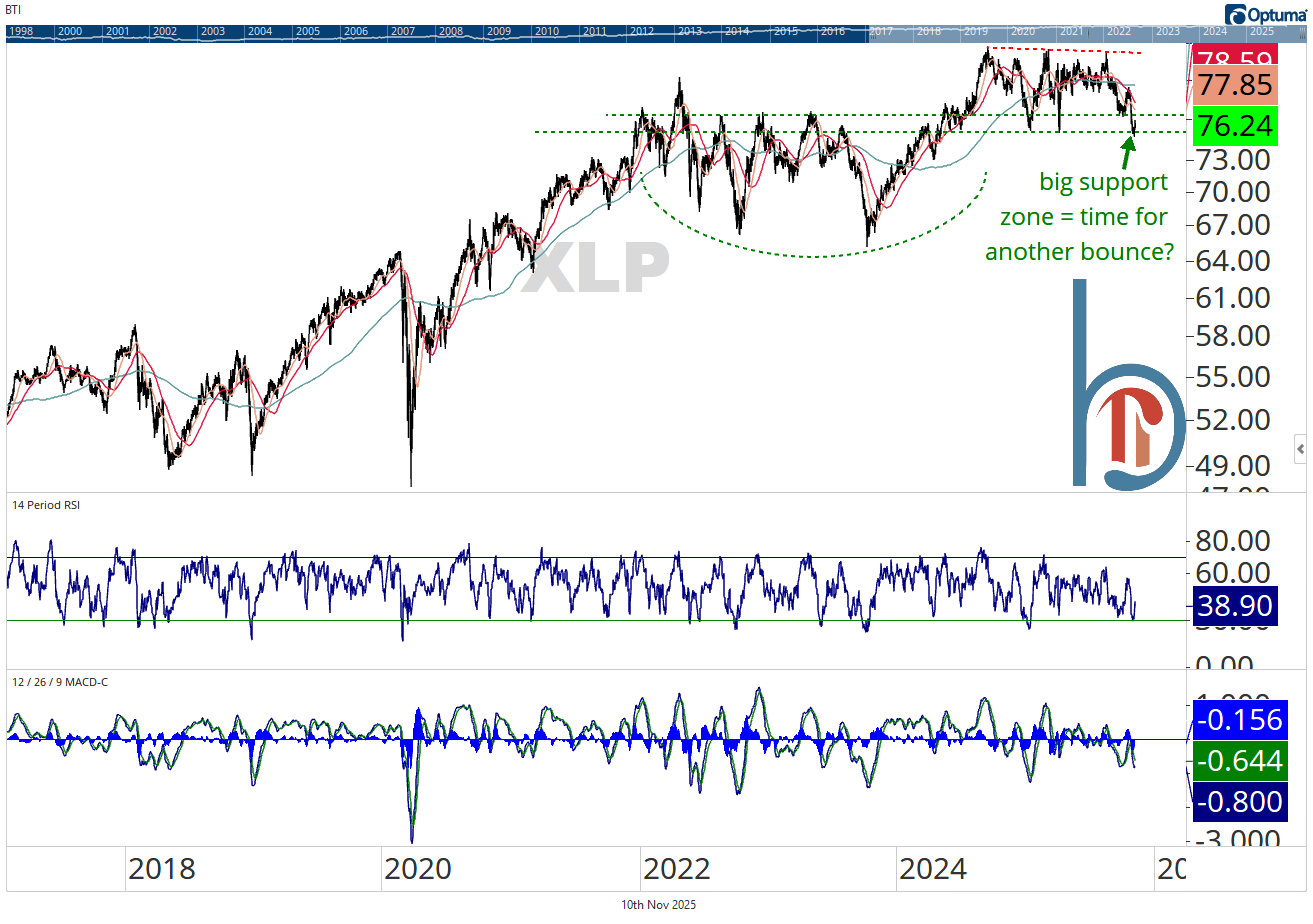

XLP bouncing from last week’s 52-week low

Only one sector has hit a 52-week low since April, and that was consumer staples last week. There’s nothing bullish about a milestone like that, but XLP bounced back strongly with a 1.5% gain on Friday. More importantly, when we zoom out, we see this is arguably a big support zone.

If we’re above last week’s low ($75.16), there’s at least a mean reversion trade in play.