Overtime

Energy sector focus

Good morning,

Unless you’re a brand-new reader around here, you know that trends and relative strength are at the core of what I do.

And zooming out, energy has had a complete lack of trend and almost no relative strength for the better part of three years (well, actually longer than that, but we’ll get to that in a second).

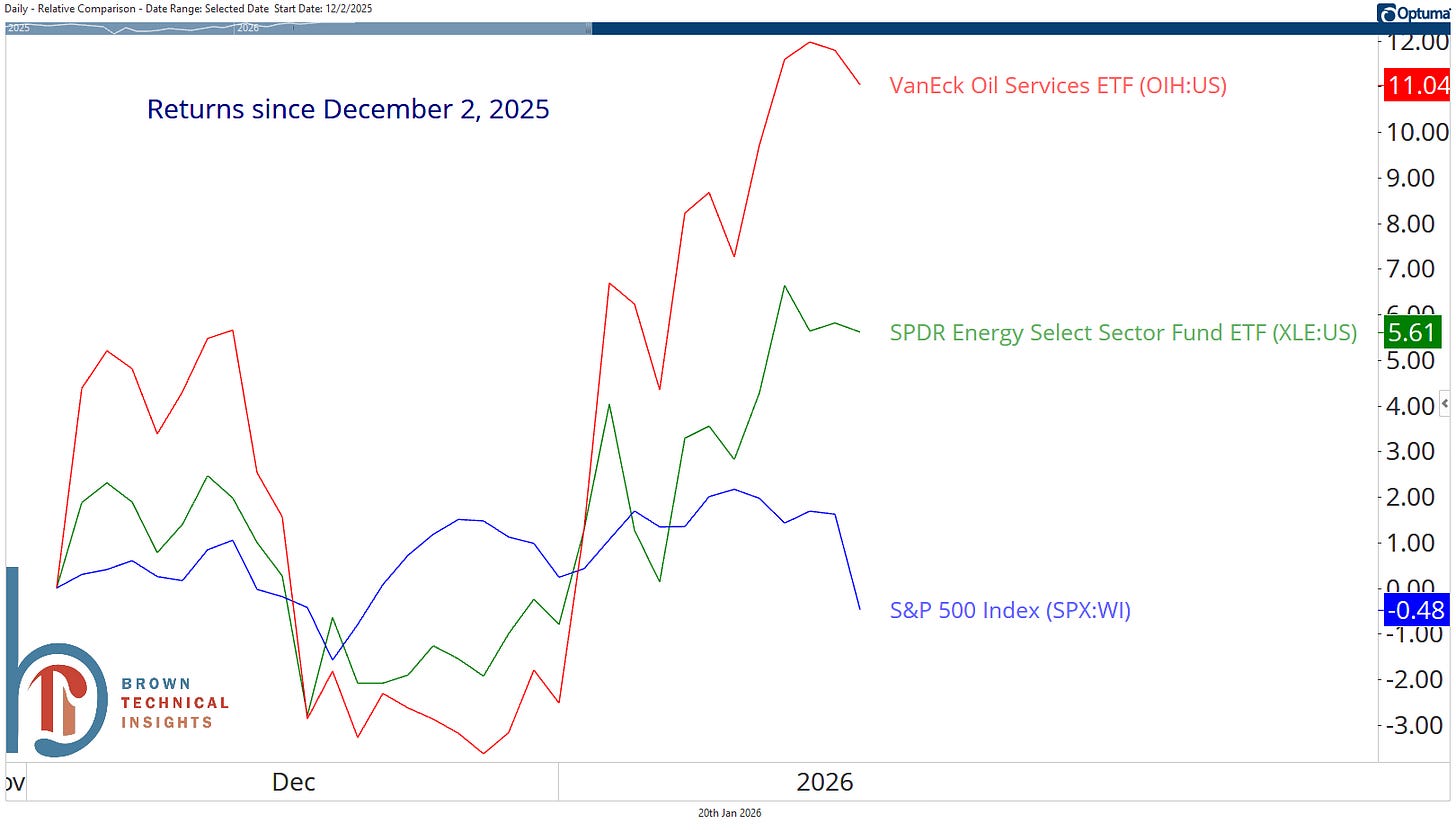

But in early September, we increased our energy exposure from 0% in our ETF models to market-weight, and in December, we doubled down, adding an oil services position that has trounced the S&P 500 in the seven weeks since:

Today, I’m going to break down why we want to remain overweight energy stocks, and why there’s the potential that this move is just getting started.

We’ll review:

Energy commodities

Top-down technicals for the sector

Key ETF sub-groups

and single stock opportunities

Let’s get into it!

Energy commodities

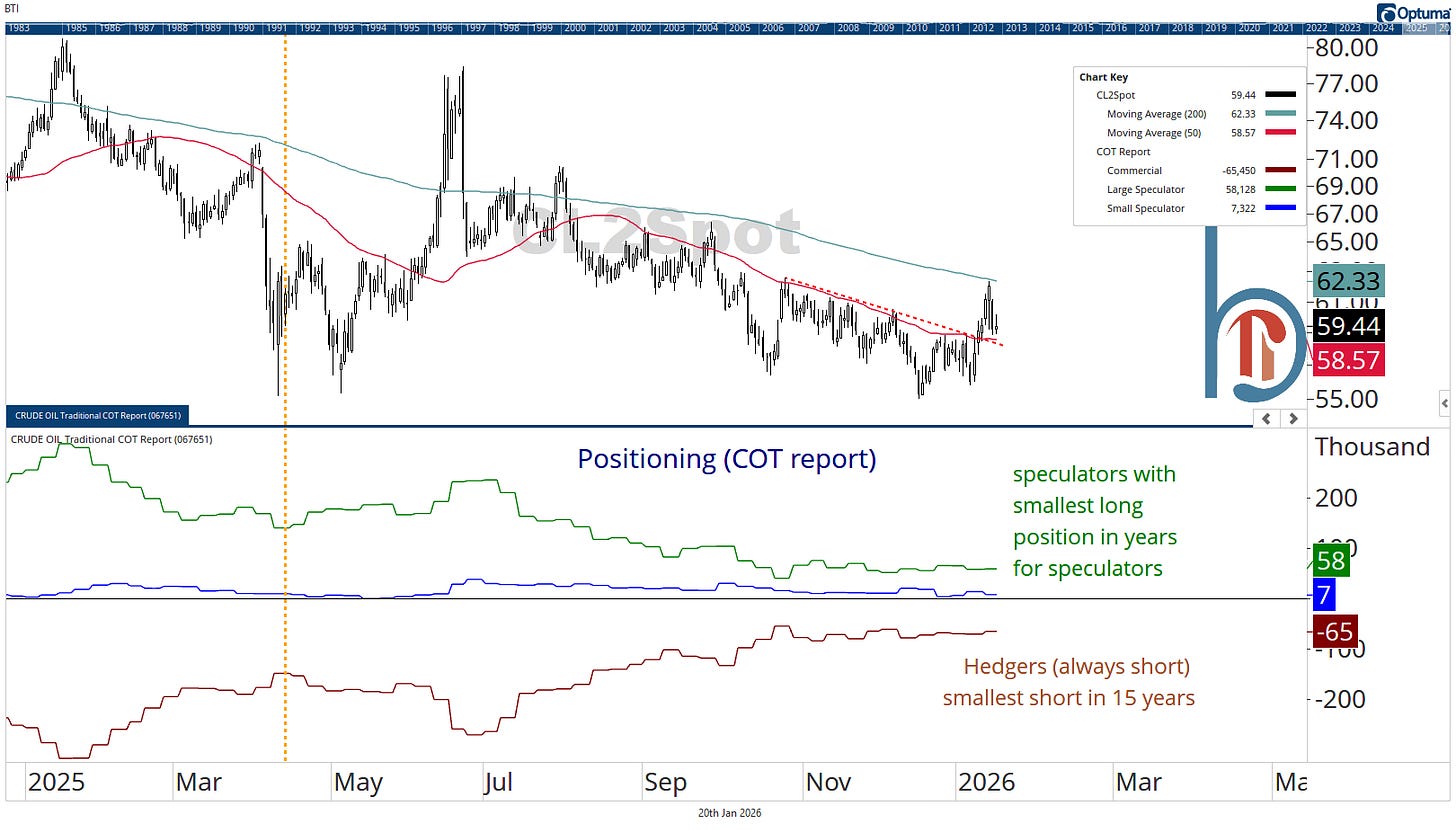

WTI is holding above the 50-DMA so far this week

Crude oil prices have been in a steady downtrend since June of 2022, and it’s too early to say that has changed. There are, however, some tactical positives. After acting as resistance since August, oil has closed above its 50-DMA for two consecutive weeks and is bouncing off that level to start this week.

In addition, as we’ve shown repeatedly in the Monday Morning Playbook, positioning looks to be offsides, with speculators holding their smallest net long position in 15 years.

We still need to overcome the 200-DMA (currently at $62/bbl.), but there’s an attractive risk-reward proposition in betting on higher crude prices, using the 50-DMA or $55/bbl. as potential stops.