Good morning,

This week we’re taking international stocks into overtime. Broadly-speaking, international equities have underperformed US equities, so they haven’t gotten much airtime in the Monday Morning Playbook. But we still want to stay on top of the technical picture, so we are there when (or if) that trend shows signs of changing.

This week we’ll break down EAFE, EM, and their major sub-components. We’ll rank them on the systematic trend scoring system we used for US sectors last week and review:

Relative strength between major markets

The most noteworthy international charts to monitor

and what I believe is one of the few investable foreign ETFs

EAFE, EM, and key geographies ranked

Japan: 6

Japan is our clear leader, with all bullish trends in absolute terms and 2/4 moving averages sloping upwards vs. the US. We’ll show how this gets better when hedging currency risk later, but want to have an apples-to-apples comparison for the rankings.

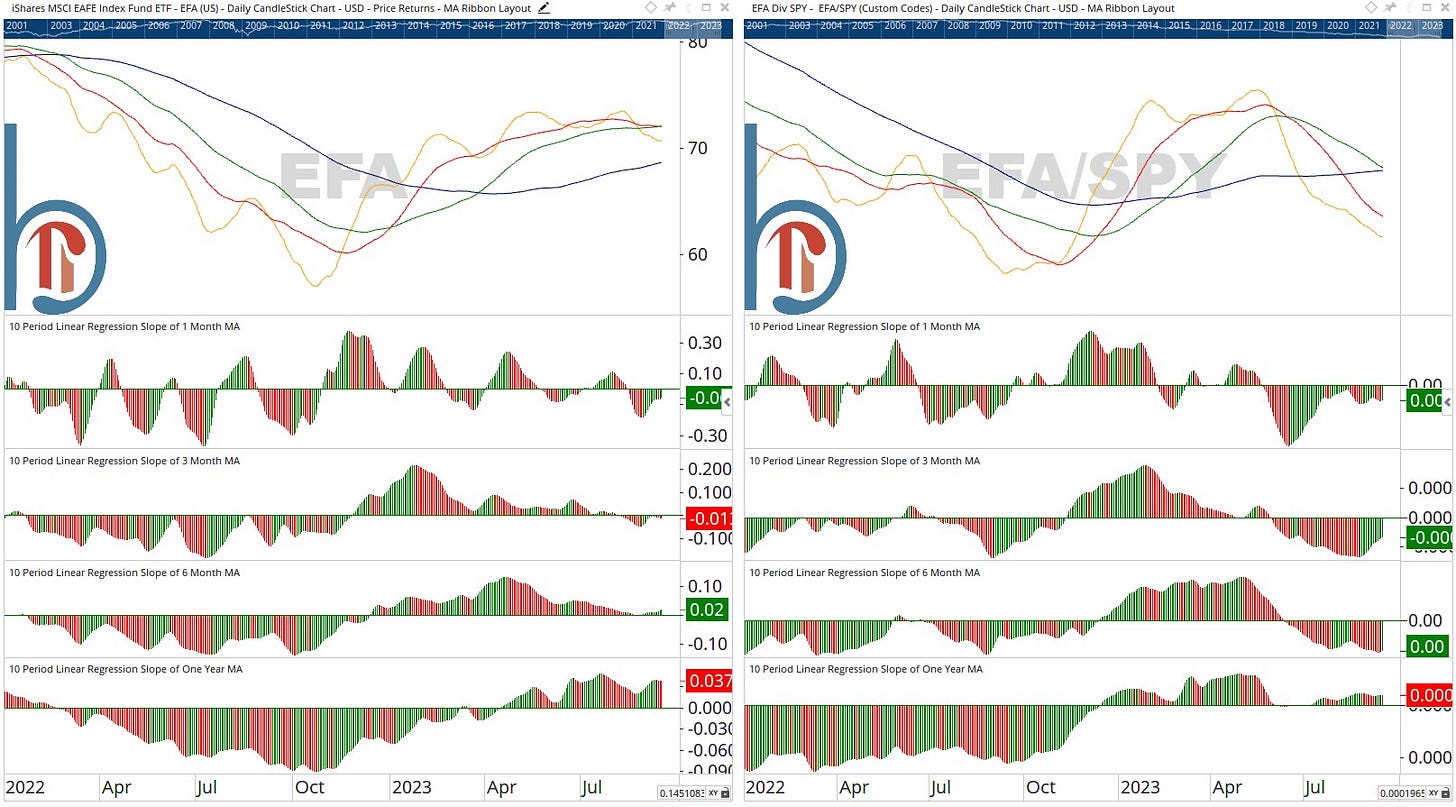

EAFE: 3

The broad MSCI EAFE ETF scores a 3, with still-positive long-term trends, but negative trends across the board in 1 and 3-month MA slopes. Not bullish enough to warrant a position in a tactical portfolio that is attempting to outperform US equities.

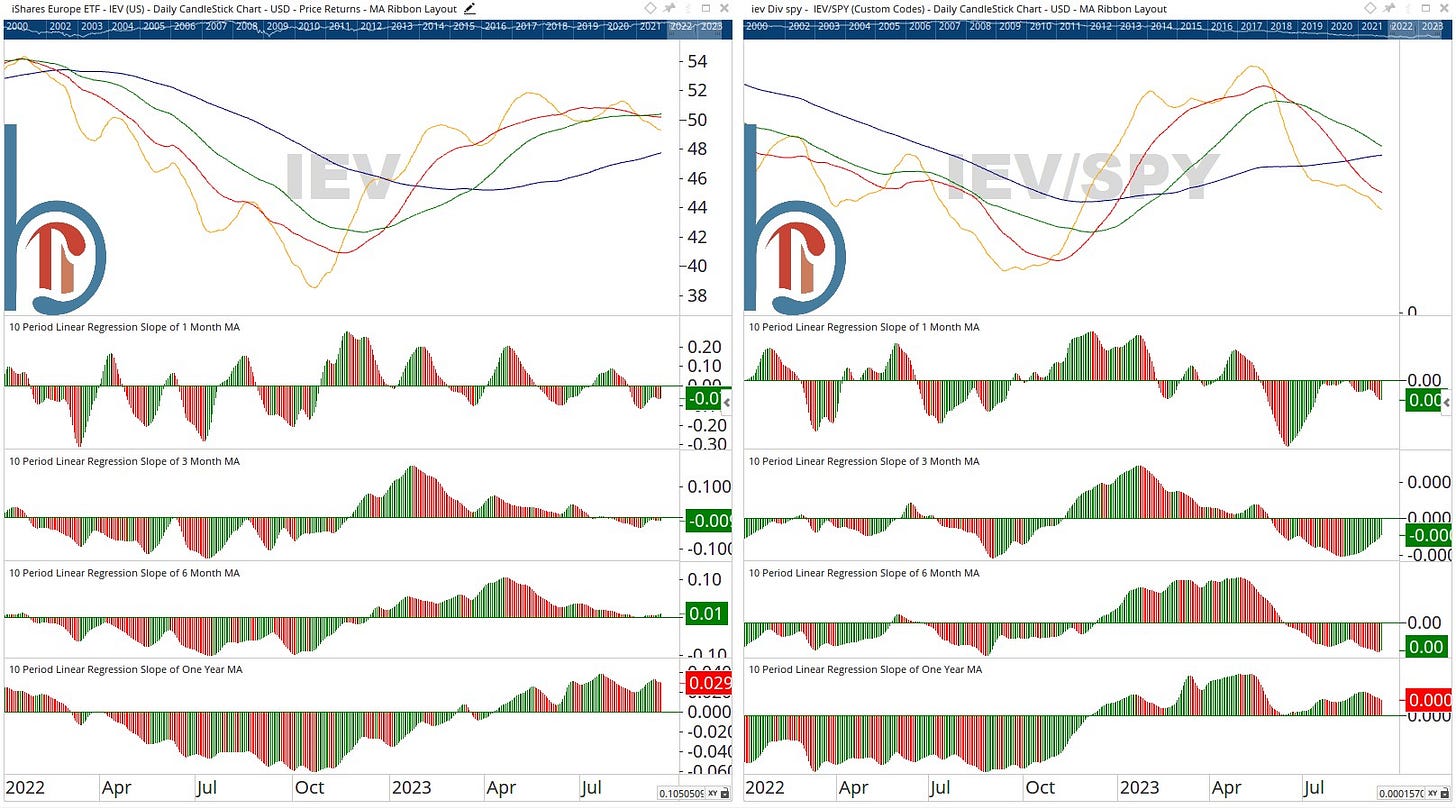

Europe: 3

Europe scores the same as broad EAFE, but since we know Japan is lifting up the EAFE score, it makes sense to rank Europe below EAFE.

Keep reading with a 7-day free trial

Subscribe to Brown Technical Insights to keep reading this post and get 7 days of free access to the full post archives.