Overtime

Mailtime

Good morning,

It’s the last Tuesday of the month, which means this week’s Overtime is Mailtime.

Thanks to everybody who sent in chart requests and a special thanks to the reader who sent in the thoughtful question below. I thought it was timely and relevant and tried give it a deserving response.

Let’s see what you had for me this week!

Questions

Of course, you always see 20/20 in hindsight, but over the past 8 years, diversification, small caps, and especially international investing just hasn’t worked out. Everyone chases the S&P 500 and none of these strategies and diversification seem to be beating it. The Ultra Growth ETF strategy has been struggling to match the S&P 500 performance as well. My question is, why not just invest 100% in the S&P 500 and not worry about all the other stuff?

My answer is simple: Risk Management.

I’d be a perma-bull over a perma-bear any day of the week, but I do think it is naive to say that the U.S. market HAS to go up forever.

Just this century we’ve seen the S&P 500 go 13 years with no gains and the Nasdaq Composite go 16. A look back through history shows many countries have gone longer1 or had highs that were never recovered2. So while some people choose to manage this risk by putting some money into every stock in every country, I believe the best way to manage this risk is with technical analysis and trend following.

Make no mistake, we are trying to outperform the S&P 500 because that’s what money managers and clients look to.

But how you get there is important. In Meb Faber’s famous trend-following study, he used a remarkably simple strategy (buy/sell when SPX is above or below its 10-month moving average). The strategy’s return from 1900-2005 was only slightly better than buy and hold (10.66% CAGR vs. 9.75%) but the standard deviation, max drawdowns, and worst years were significantly less.

Said another way, you got similar returns with far less risk.

Another point I want to make is that while the S&P 500 has advantages that make it hard to beat (low cost, rules-based, and essentially a momentum strategy that adds to winners and kicks out losers) the extremity of the current environment is absolutely an anomaly.

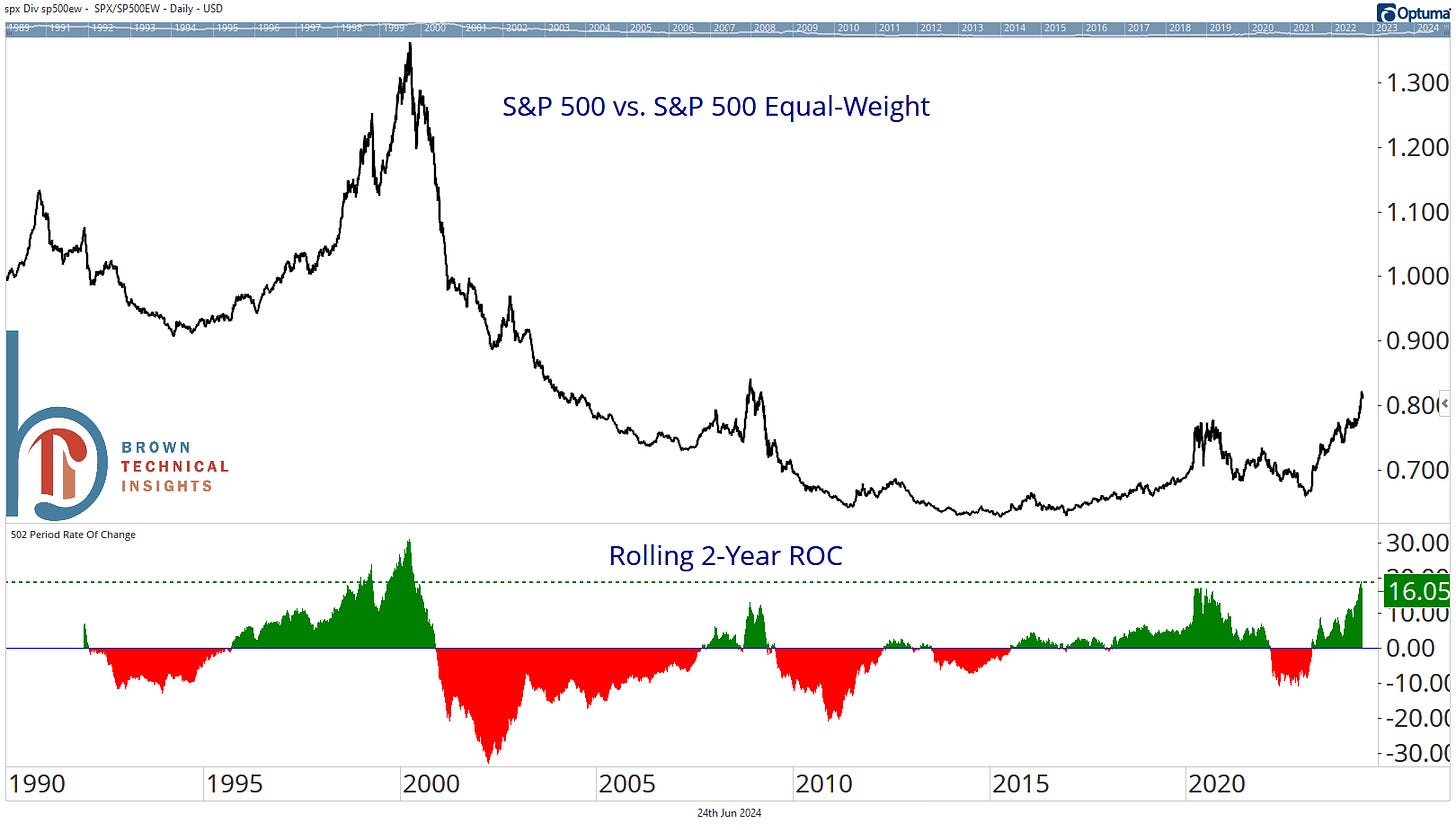

The cap-weighted S&P 500 has outperformed the equal-weight index by 16% over the trailing 2 years, which is the most we’ve seen since the dot-com bubble.

In addition, the percentage of stocks outperforming the index YTD is tracking to a multi-decade low for the second year in a row (h/t Richard Bernstein Advisors).

None of this means the trend will end tomorrow. And I don’t think we’re dealing with another dot-com bubble. But I would encourage anyone not to abandon active management for passive just when concentration risk has increased the most (h/t to the great Todd Sohn for the chart below).

Chart Requests

ADBE: Adobe

Adobe has popped back above $500 which should act as support but the chart is largely trendless and neutral in absolute terms. Resistance at the 200-DMA and $575.

AMZN: Amazon

Amazon is setting up nicely but the stock was turned away at $190 again yesterday. Just below resistance makes this a tough entry point, but I’d be a buyer of a breakout.

CNQ: Canadian Natural Resources

We looked at a MACD buy signal in XLE in yesterday’s Playbook and when I go chart by chart, nearly every stock in the sector is printing one. CNQ is no exception and the stock just bounced strongly off support. $33 is your stop, first resistance will come at $36.57.