Stock Trends

The password is rotation

Good morning,

This week’s password is rotation.

But if you’ve been paying attention, the rotation has been in the works for a while.

Homebuilders began leading mid-June. A month ago, an edition of this report was titled, “The aerospace & defense correction is here”, and, in what is becoming more and more of a tell in hindsight, the Microsoft and Meta earnings have all the makings of a classic blow-off top.

However.

If you’re concerned with the health of this market. Don’t be.

Because the money hasn’t been leaving those stocks and going to cash. Not by a long shot.

It’s been pouring into the cyclicals, the defensives, the income plays, and even the small caps.

Tuesday’s bloodbath in the speculative world? The equal-weight S&P 500 was up on the day.

Palantir down 9%? I’ll raise you Prologis (the largest weight in the real estate sector) up 5.1% and Home Depot up 3.2%.

Think the consumer is tapped out? What about 52-week highs for Wynn Resorts and Live Nation?

Don’t get me wrong. The tech stocks have a disproportionate impact on the S&P 500, so if you’re all in there, it doesn’t mean the next few weeks will be smooth sailing. But, in this seasonally tricky time, if the worst the market throws at us is rotation with cyclicals rallying, investors should feel pretty good about what’s on the other side as we look toward the end of the year.

This week, we’ll review:

Key levels and technicals for some of this week’s biggest losers

Where the money is going

Hot List updates

and more!

Rotation out of

🚨Quick note before we dive into these. The big theme yesterday was many of these stocks saw bullish daily reversals, often referred to as hammers or dragonfly dojis. There are two things to know about all the stocks that saw such a reversal yesterday:

It’s not a reversal without confirmation today. Those stocks need to see upside follow-through, or you don’t have a bullish reversal signal.

Yesterday’s intraday low is now a key line in the sand, whether we see confirmation today or not. I’ve tried to call out as many as possible in the charts below.

The OG momentum play: Palantir (PLTR)

Palantir was down as much as 25% from recent highs at yesterday’s low, but saw buyers step in and close it more than 9% off the lows for only a 1.1% loss. This keeps $148 support and the 50-DMA intact, but we need to see a green day today to confirm the candlestick reversal. Yesterday’s low ($142.34) is now tactical support and any break would support more downside, with next support coming in from $125-$128.

Space and drone stocks: Kratos Defense & Security Solutions (KTOS)

Former Hot List stock KTOS moved on to new highs after a four-week consolidation but is pulling back to the top of that base. $61.50 is key support for anybody who held.

Space and drone stocks: Rocket Lab (RKLB)

Rocket Lab was never able to break out of its descending wedge and is already in a 28% drawdown. It found dip-buyers at the 50-DMA but investors need to see more signs of stabilization before getting excited about this high-flyer.

Quantum: D-Wave Quantum (QBTS)

I’ve really liked QBTS, but the recent break of the 50-day puts it in the penalty box near-term and delays a potential breakout. A green day today would be a start, $14.20 is yesterday’s low to watch.

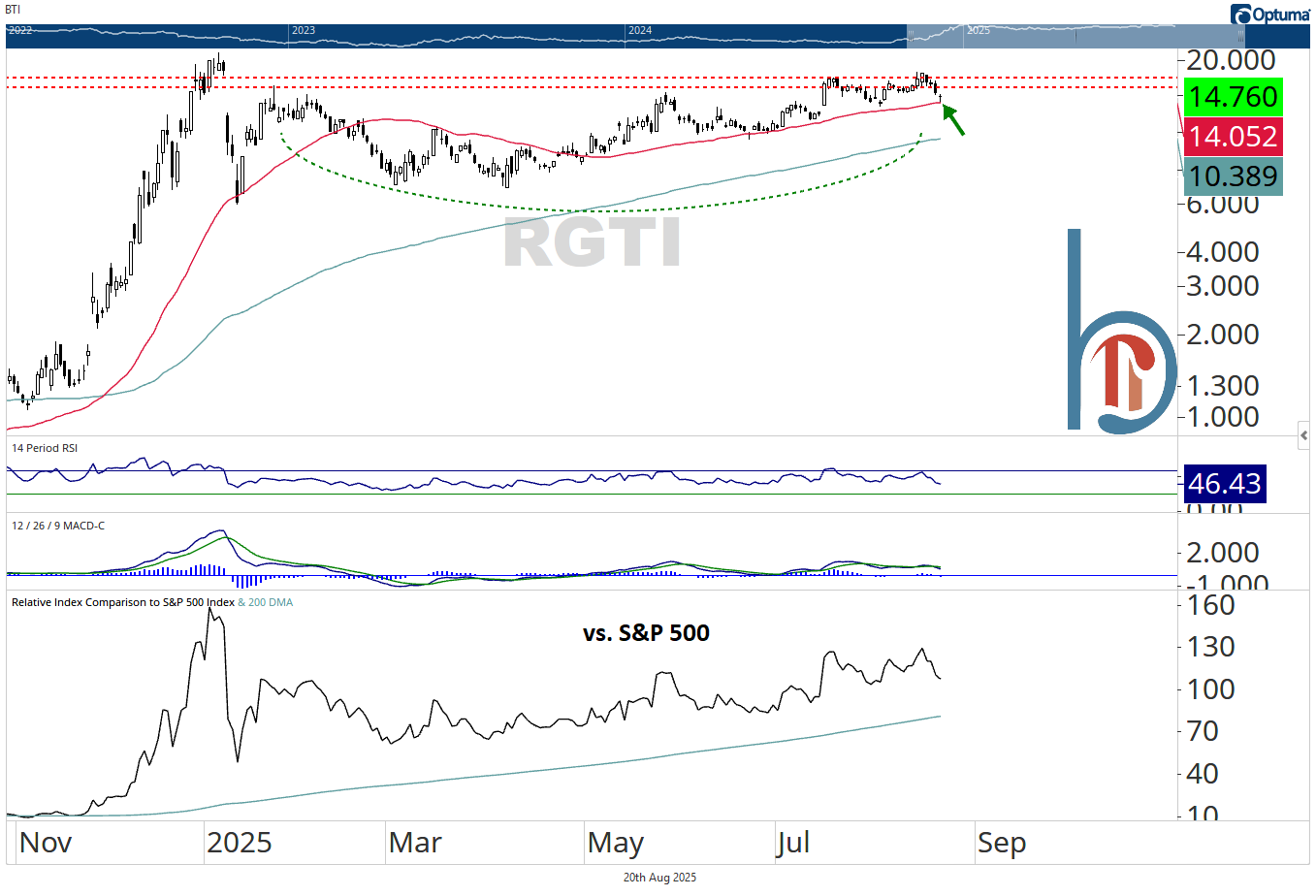

Quantum: Rigetti Computing (RGTI)

RGTI hasn’t broken down, but must continue to hold the 50-day. If it can rally here, it’s a top stock to watch with the potential to vault out of this 8-month base. $14 is your tactical support.