Stock Trends

Open up your mind, man

Good morning,

This week, we’re talking drug stocks. And while everybody on TV is noticing the improvement in healthcare this week (we were looking at it in mid-August), I’m not talking about the multi-billion-dollar pharma companies. I’m talking “fun” drug stocks.

This may seem a little niche, but President Trump took it more mainstream this weekend when he posted a promotional video for CBDs on his Truth Social account.

That sent the Amplify Alternative Harvest ETF (ticker: MJ) up more than 26% on Monday, its second-best day ever.

As is often the case with big surprises, the charts had already turned their favor. And they aren’t the only ones. We’ve looked at the bottom in psyilocybin stocks a few times recently, and today I’ll share my three favorite setups there as well.

We’ll also look at:

Healthcare and utilities breaking out

Semiconductors making new highs

Hot List updates

and more!

🚨Common sense alert 🚨

It should go without saying that investing in stocks whose primary product is on legal murky ground is inherently riskier than investing in stocks within the S&P 500. Some of these could be considered “low-price” or “penny stocks”, and the volume or liquidity may be low or uneven. Know your risk tolerance, time horizon, and goals before investing. Nothing in these pages is advice. I try to point out groups showing relative strength, and these are some of the top technical setups I see.

The pot stocks keep getting higher

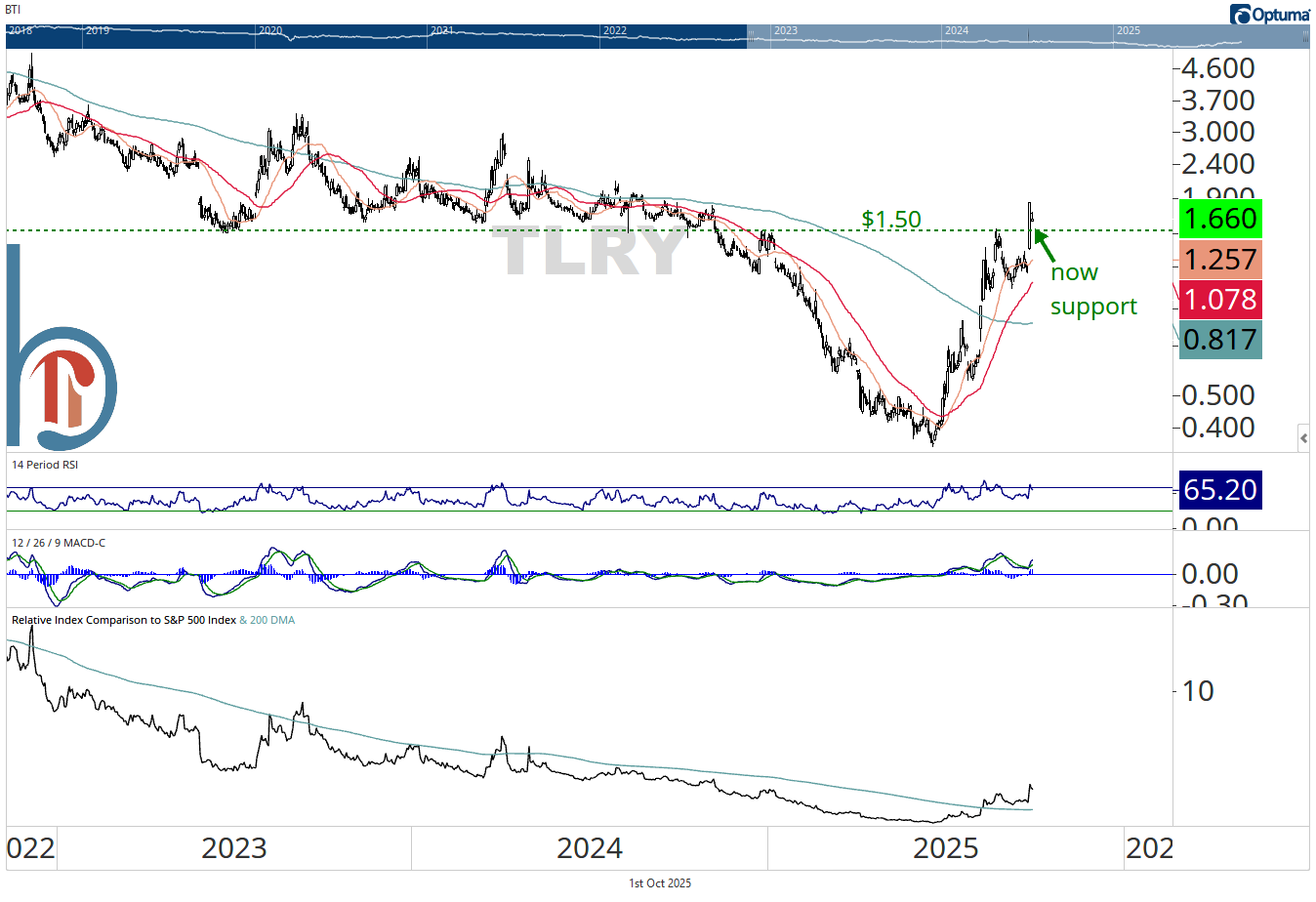

Tilray breaks through a huge level on Monday

You can manage risk against the $1.50 level, and this is the “name brand” in a tiny space with a $2 billion market cap and a nearly 20% weight in the MJ Altenative Harvest ETF. But the following four stocks are better technical setups.

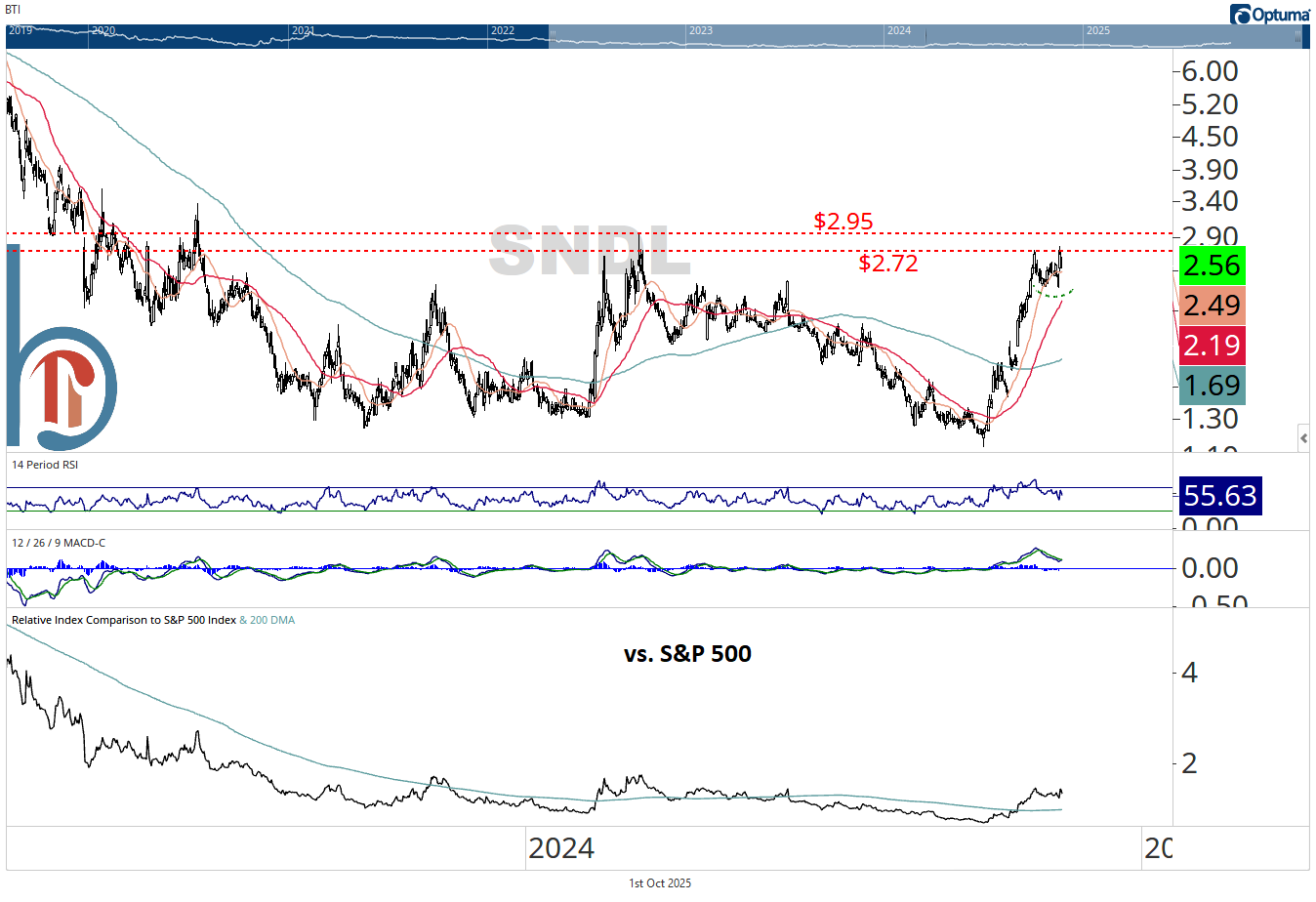

SNDL has a sweet-looking base

Pulling back from resistance the past two days, but if we’re above $2.30, I like this small consolidation to resolve higher and try again at the bigger breakout.

Similar look for Cronos Group

A move above $3.13 completes a multi-year double-bottom pattern for CRON. $4.60 is a realistic target if it can break out.