Overtime

Software

Good morning,

We’ve had some successful Overtime reports on sectors that have been “so bad, they might be good, focusing on healthcare back in August, and consumer staples more recently in November.

Despite horrible relative trends at the time, both sectors posted turnarounds and have strongly outperformed the market since those reports.

Today, we’re going to focus on another area where recent selling and underperformance are extreme: Software.

I’ll tell you right up front, I’m not nearly as encouraged by what we’re seeing in software and am definitely not calling a bottom. In the monthly ETF trades following the healthcare and consumer staples reports, we added to both sectors, covering our underweight and moving to market-weight.

I do not see that happening for software in the March updates and will break down why in today’s report.

However, that doesn’t mean there aren’t opportunities, and today’s report will look at:

Just how extreme and oversold the group is right now

ETF flows

Short and long-term technicals for IGV + the base case going forward

Single stocks to continue to avoid

Five stocks to play a potential bounce in the group

and two stocks that have bucked weakness and look set for more gains

Putting the crash in perspective

We’ve only been this oversold in true bear markets

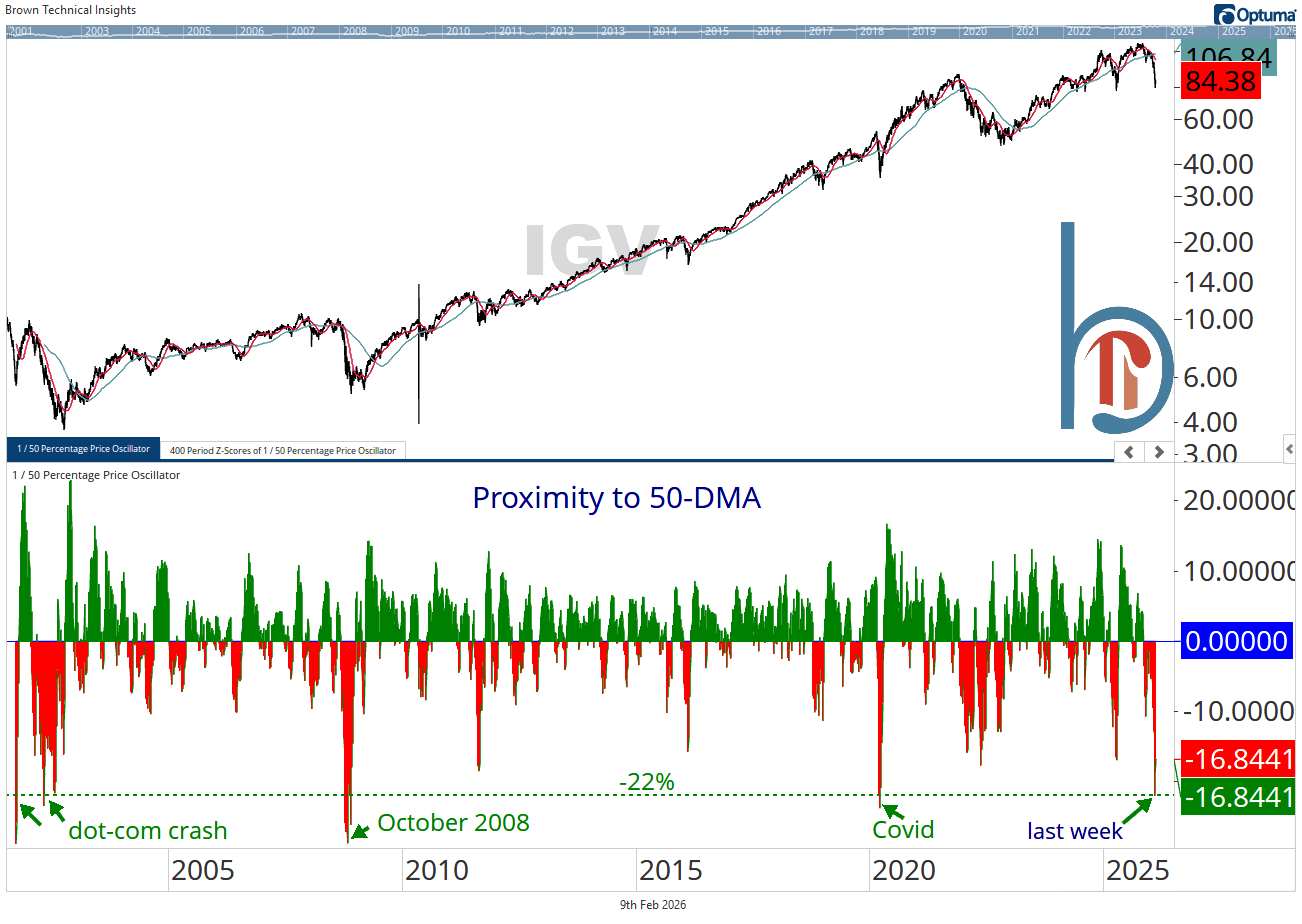

Last Thursday, IGV reached 22% below its 50-DMA, a reading we’ve only seen during the three worst bear markets over the past 30 years.

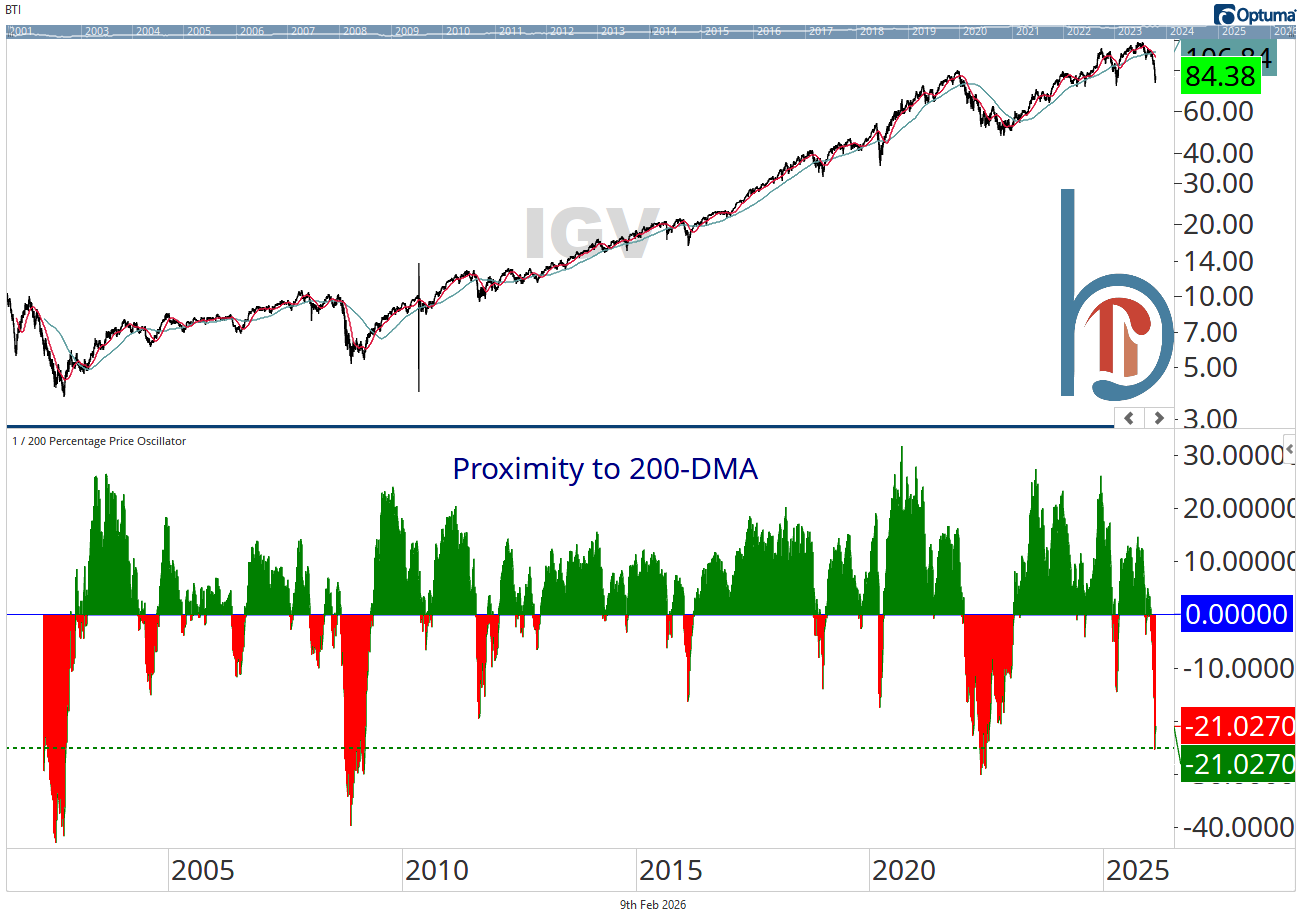

Relative to the 200-DMA, this is the fourth-most extreme reading we’ve seen, trailing the dot-com crash, the GFC, and the recent 2022 bear market.

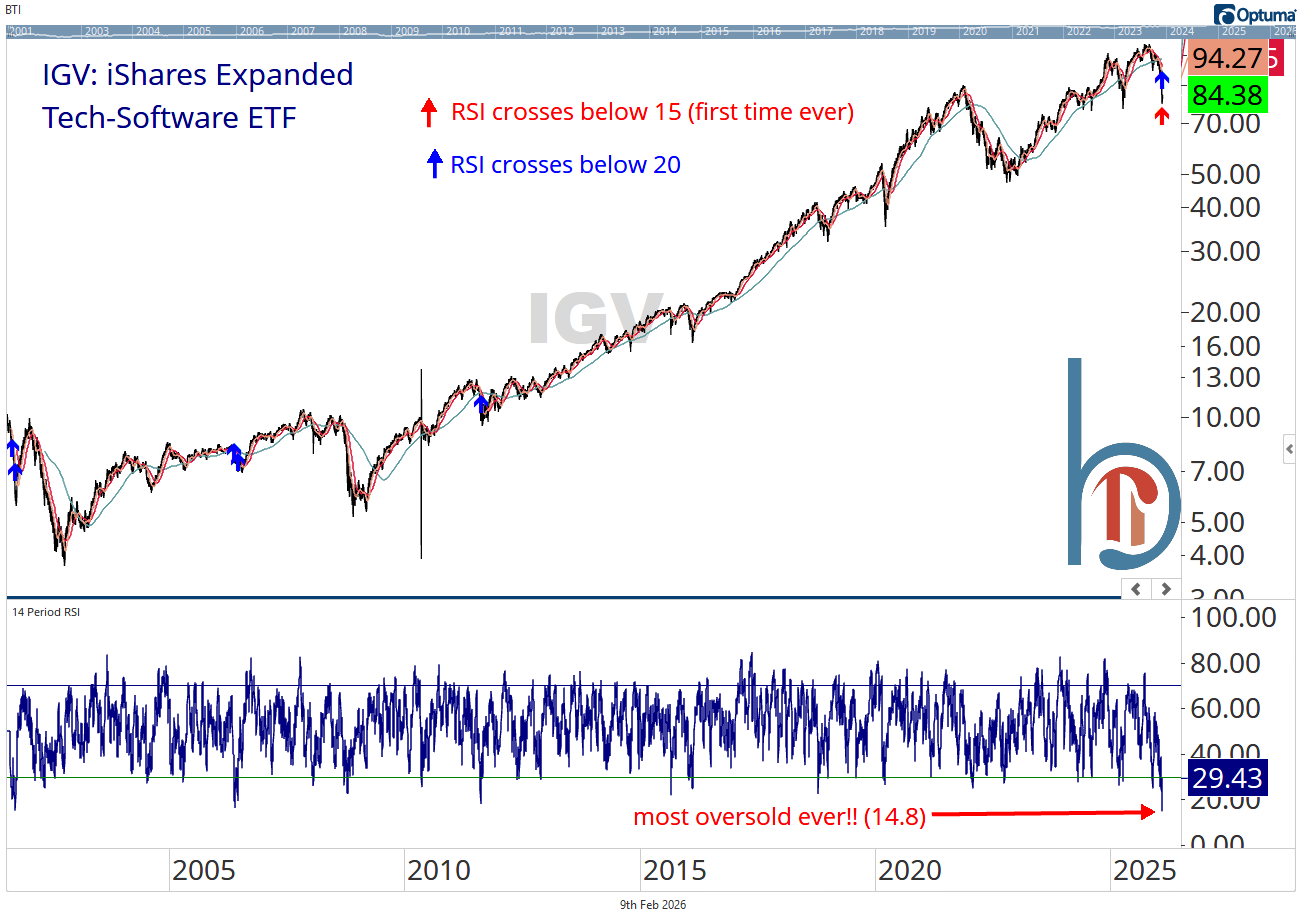

Most oversold RSI-14 reading ever

Last week, IGV’s RSI-14 went below 15 for the first time ever. Above in blue are the only other times we’ve seen this oversold reading go below 20.

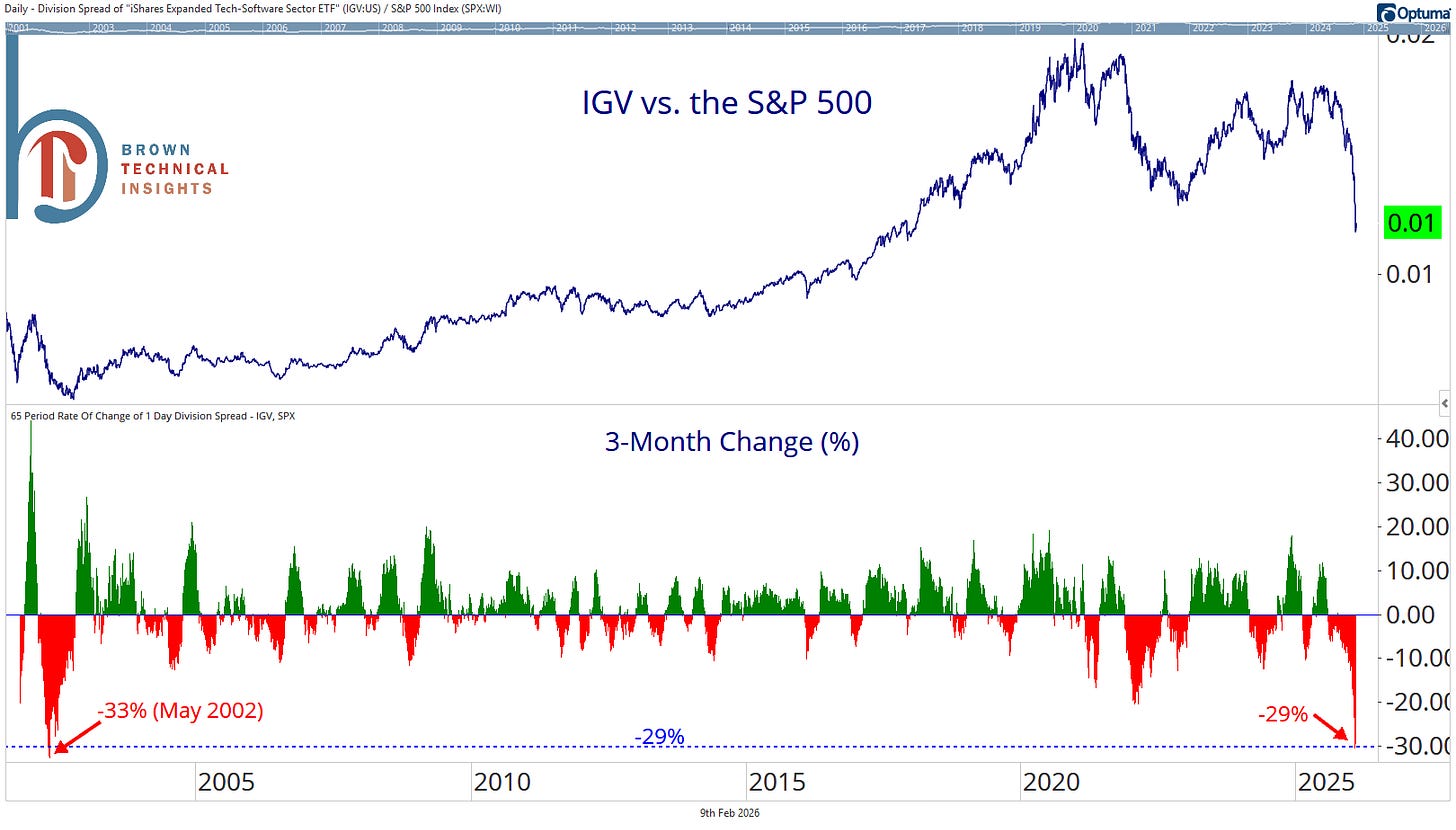

Worst three months of relative performance since 2002

Note that the extreme of the underperformance happened in May 2002, but the ratio didn’t bottom until October of that year. More on that significance in a second.